Expenses for fuels and lubricants: accounting and automation. Accounting for fuel and lubricants in 1C: instructions for accountants How to write off gasoline in accounting 8.3

Including fuel cards. It would be incorrect to use “Operation entered manually” in this situation. The whole catch is that in this case you will reflect only the accounting entries, leaving out the rest, possibly necessary registers.

Let's look at step-by-step instructions for accounting and writing off fuel.

Receipt of fuels and lubricants

Go to the “Bank and Cash Office” section and select “Advance reports”.

Create a new document and indicate the reporting person in the header. In the product table, indicate the previously recognized product item. In our case, this is “Gasoline AI-92”. It is very important to correctly indicate the accounting account - 10.03 “Fuel”.

You should not have any difficulties filling out this document. Once you have provided all the required information, complete it.

In our example, we used an individual entrepreneur as an organization on a simplified taxation system (income minus expenses). In this regard, the document formed movements not only in accounting and tax accounting, but also in the accumulation registers “Other calculations” and “Expenses under the simplified tax system.”

If you reflected the receipt of fuel and lubricants with a “Manually entered operation”, then the movements would be in only one register - the accounting register. It is incorrect to do this due to the fact that something may not be taken into account depending on the chosen taxation system.

Write-off of gasoline

It is most correct to reflect it in 1C 8.3 with the document “Requirement-invoice”. The reason is the same as in the previous example. In addition, it is much more convenient to work with documents than directly with entries in the register.

In the previous example, we reflected the receipt of 30 liters of AI-92 gasoline, which are now registered with Gennady Sergeevich Abramov. Let's say we need to write off 20 liters due to a trip.

Accounting for the write-off of fuel and lubricants in 1C Accounting will be carried out using the invoice requirement. Filling out the header of this document is practically no different from the previous one.

Next, on the “Materials” tab we will indicate our AI-92 gasoline in the amount of 20 liters. It is more convenient to fill out this tabular part using the “Selection” button due to the fact that in this way you can immediately see the remains of a particular item.

Also, when filling out the tabular part, it is important to indicate correctly (10.03, as in the advance report).

We have filled in all the data and can process the document. In the image below you can see that two transactions have been generated for writing off fuel and lubricants to a cost account.

Since our organization uses a simplified tax system of income minus expenses, there will be two movements at once on the “Expenses under the simplified tax system” tab. The first line will reflect the expense of funds for the purchase of fuel and lubricants in the advance report. The second line is the receipt reflecting the write-off of fuel and lubricants.

Reflect fuel and lubricants accounting in 1C 8.3 correctly, then when closing the month, all such expenses will be taken into account.

See also video instructions for writing off materials:

Waybill is a document on the basis of which the costs of fuels and lubricants are taken into account. The printed form (form according to OKUD No. 0345001) is not mandatory for all organizations except transport companies. In typical 1C 8.3 configurations there is no printed waybill form (you can add it as an external one), but several methods are implemented:

- According to advance reports

- By coupons

- By fuel cards

Let's look at step-by-step instructions and some features of each of them.

The accounting scheme looks like this:

- Issuing cash to an accountant

- Preparation of an advance report

- Cash back to the cashier

- Write-off of costs for fuel and lubricants using fuel cards

Figure 1 shows an advance report, which reflects several operations at once: a report on the advance payment issued, the receipt of gasoline to the warehouse, information on the invoice (if there is one).

In Fig. 2 you can see the document postings. In order for accounting accounts for the “AI-92 Gasoline” product to be filled out automatically, you need to add a line for the “fuels and lubricants” group in the information register “” (see Fig. 3)

The printed form of the waybill can be connected as an external report or processing to the “Additional reports and processing” directory (see Fig. 4). The report itself will have to be ordered from specialists or purchased from Infostart.

The return of money on the advance report (in our example it is 8 rubles) is drawn up in the document “”, which is filled out automatically in the “Enter based on” mode from the document “”.

Write-off of fuel and lubricants using fuel cards

Unlike coupons, fuel cards are accounted not as, but as strict reporting forms in off-balance sheet account 006.

In general, the accounting scheme consists of the following points:

- Posting a fuel card

- Posting of gasoline received using a fuel card

- Write-off of expenses.

The capitalization of the cost of a fuel card can be recorded as a receipt of service - see Fig. 11 and Fig. 12. And the card itself is accounted for in account 006 by manual operation (Fig. 13)

The receipt of fuel is documented with the document “ ” (see Fig. 14, Fig. 15).

How to take into account fuels and lubricants in the 1C 8.3 Accounting 8.3 program? Why is there an error when entering a document manually?

Accountants often make the mistake of writing off fuel and lubricants in 1C 8.3 as an operation entered manually. This is not entirely correct. The fact is that when manually entering transactions, only accounting accounts from the chart of accounts (“Accounting registers”) are affected. But in fact, this is often not enough, since other accounting registers may also be involved in the capitalization of fuel and lubricants.

Let's look at the example of the receipt of fuel and lubricants by preparing an advance report, and then step-by-step instructions for writing off fuel and lubricants in 1C Accounting 8.3.

Receipt of fuel and lubricants using an Advance report

Let’s create a new advance report document (menu “Bank and cash desk” – “Advance reports”):

Don't forget to set accounting account 10.03 (Fuel). Let's go through the document and see what fuel and lubricants transactions have been generated.

Click on the post debit credit button:

As you can see, in addition to the accounting entries, movements in two registers were also formed. When manually entering a write-off entry, we will write off only fuel and lubricants from the 10.03 account - Fuel, and will not affect other registers. In the future, this can lead to accounting errors and incorrect reporting.

Correctly document the write-off of fuel and lubricants using the document “Requirement - invoice”.

Write-off of fuel and lubricants in 1C using the document “Requirement - invoice”

And so, there are fuels and lubricants in account 10.03, analytics “Main warehouse”, in the amount of 20 liters. Now, according to the driver’s report and taking into account the standards, they need to be written off.

Let's create a new document “Requirement - invoice”. Go to the “Production” menu, then in the “Product Release” section, select “Requirements - invoices”. In the window with a list of documents, click the “Create” button.

In the header of the document, fill in the details “Organization” and “Warehouse”.

In the tabular part, on the “Materials” tab, add our “AI-95 Gasoline” and indicate the quantity and, if necessary, the correct accounting account (10.03):

Here, in fact, the document is ready. Click “Post” and look at the transactions:

As you can see, in addition to accounting entries, movements are also generated in the “Expenses under the simplified tax system” register (as in the advance report). This cannot be done in a manual operation.

When closing the month, these costs will be distributed to the financial result in accordance with the accounting policies of the organization.

Based on materials from: programmist1s.ru

Institutions and organizations with vehicles are forced to buy gasoline, diesel fuel and other fuels and lubricants every day. The most common ways to purchase fuel and lubricants are in cash or with an advance report, as well as using fuel cards.

Let's look at how these methods of accounting for fuel and lubricants are implemented in 1C: Accounting 8.3.

Accounting by cards

The plastic fuel card payment system is the most convenient and profitable form of payment for fuel. The organization enters into an agreement with a fuel and lubricants supplier for the purchase of gasoline using a fuel card, which stores information about the established limits on the quantity and range of petroleum products and related services, as well as the amount of money within which petroleum products and related services can be obtained.

Capitalization of the cost of a fuel card (if there is one, since in most cases the card is used free of charge if it is returned) can be registered as a receipt of services through the “Purchases” menu - “Receipts (acts, invoices)” - create a receipt “Services (act)” ).

Fig.1 Creation of the “Services” document

Fig. 2 Filling out a service document - production of a fuel card

In this case, the fuel card itself is taken into account as a strict reporting form on off-balance sheet account 006 and is reflected in accounting using a manual operation - menu “Operations” - “Operations entered manually”.

Fig.3 Operation entered manually – reflection of the fuel card as off-balance

Please note that if a fuel card is produced free of charge, the card is also displayed on off-balance sheet account 006 “Strict reporting forms” at a conditional price - 1 card = 1 ruble.

At the end of the month, the fuel supplier provides documents reflecting the number of liters actually purchased, which is the basis for accounting in account 10.03 “Fuel” and is issued through “Receipt of goods (invoice)”, in the “Purchases” menu - “Receipts (acts, invoices)” .

Fig.4 Menu of the 1C: Accounting program “Purchases”

We create a new document “Receipt of goods (invoice), fill in the organization, supplier, contract, warehouse and add rows to the tabular part “Goods” using the “Add” or “Selection” button. When creating an item, be sure to specify the type of item - fuels and lubricants.

Fig.5 Nomenclature card for fuels and lubricants

Fig.6 Registration of receipt of fuel and lubricants

Thus, we received fuel and lubricants from the supplier. The wiring has been formed - Dt. 10.3 - Kt. 60.

Fig.7 Movement of the document “Receipt of goods (invoice)”

Receipt of fuel and lubricants according to advance report

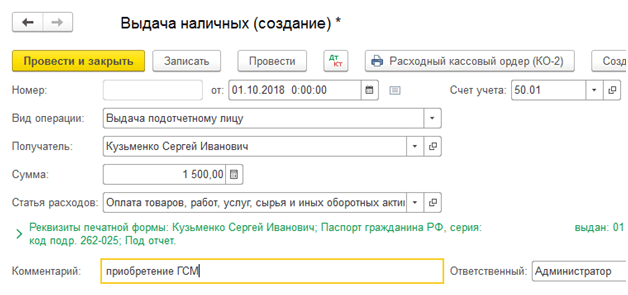

To reflect the driver’s independent purchase of gasoline using cash issued to him, we draw up an advance report. In this case, you first need to formalize the issuance of funds to the reporting employee. The issuance of money from the cash register is recorded in the document “Issuance of cash” with the type of operation “Issue to an accountable person.”

Fig.8 Filling out the cash withdrawal document

Now let’s create the “Advance report” itself through “Bank and cash desk” - “Advance reports”.

Fig.9 Cash documents

Using the “Create” button, we create a new document in which we fill out the first tab “Advances”: we record the document for issuing the advance (we have “Cash Withdrawal”), and at the bottom – the documents attached to the report. Next, we proceed to filling out the tabular part, in which we select the purchased product range (Ai-95 Gasoline), indicating the quantity and price.

Fig.10 Filling out the report

Thus, we capitalized fuel and lubricants through an advance report. His postings are Dt. 10.3 - Kt. 71.01. By clicking the “Print” button we get a printed form of the document.

Fig. 11 Printed form of the expense report

Write-off of fuel and lubricants in 1C 8.3

Accounting for the write-off of fuel and lubricants in 1C is carried out according to waybills. This information is verified with reports provided by the reporting employee himself and summarizing the data from waybills and gas station receipts.

The write-off of gasoline and other fuels and lubricants is documented in the same way using the “Demand-invoice” document, which is located in the “Warehouse” section.

Fig. 12 Fragment of the “Warehouse” menu item

In the document, using the “Selection” or “Add” button, the name of the fuel, volume and account to which we will write it off are indicated. The latter, in turn, depends on the type of activity of the company: for example, if the company is a trading company, then the write-off account is 44.01, production (for main production) is 20, and general business needs is account 26. Checking the “Cost accounts” box on the “Materials” tab, will make it possible to indicate accounts on the same line with the nomenclature. Otherwise, they will be filled out on a separate tab.

Fig. 13 Filling out the “Requirements-invoice” for writing off fuel and lubricants

When making an invoice claim, the cost of gasoline written off as expenses is taken into account at the average cost.

Fig. 14 Report on the movement of the document “Demand-invoice”

The same document can also be generated on the basis of an expense report. To do this, open the report itself or the entire “Advance reports” journal, click the “Create based on” button and select the document you are looking for.

Fig. 15 Creating a “Requirement-invoice” from an “Advance report”

Setting up subaccount 10.03 “Fuel”

In our example, we use one warehouse for fuel receipt. If you have several vehicles, then you can create your own warehouse for each vehicle and take into account the balances and turnover for each unit of transport.

In order for accounting on account 10.03 to be carried out in the context of warehouses, let’s look at the account settings in the chart of accounts. Let's open the account 10.03 – “Fuel”. Here, the composition of subconto types is determined by setting up the chart of accounts “Inventory accounting”. By checking the “Inventory accounting is carried out by storage location” checkbox, we receive an additional sub-conto in the form of warehouses, accounting for which can be carried out both in quantitative and quantitative-cumulative terms.

Fig. 16 Setting up the “Storage Locations” subconto of account 10.03 “Fuel”

Fig. 17 Window for setting up the chart of accounts – account 10.03 “Fuel”

For example, let’s repost our created documents, changing the “Main warehouse” to the “Car” warehouse. After these changes, “Warehouse” was displayed in the transactions, and when creating the balance sheet, it became possible to add the “Warehouses” subaccount.

Fig. 18 Setting up the balance sheet for account 10.03 “Fuel”

As you can see, in the SALT the conditional warehouse “Car” was allocated.

Fig. 19 WWS for account 10.03 “Fuel” with details by storage location

Previously purchased fuel is reflected in the SALT without indicating the warehouse - “...”.

Given the presence of a large number of vehicles, sources of financing, various types of activities, as well as units that consume fuels and lubricants, the institution faces an urgent need to automate the issuance of waybills and the correct write-off of fuels and lubricants.

In the program "1C: Public Institution Accounting 8", ed. 2.0, to account for waybills for various vehicles, worksheet for units that consume fuel and lubricants in accordance with the standards, the subsystem “ Accounting for fuel and lubricants».

In order to start using the fuel and lubricants accounting capabilities in the program, you need to go to the menu item “ Administration» - « Setting up accounting parameters» - « Specialized subsystems" In this tab, you must check the box “ Accounting for fuels and lubricants» to reflect documents in this area.

- « Standards for calculating fuel consumption for units" And " Standards for calculating fuel consumption for vehicles»;

- « Correction factors in percent" And " Correction values for calculating fuel consumption rates»;

- « Vehicle routes».

In the menu item " Administration» as necessary, directories on the type of fuel used, license cards, bus routes and driver fuel cards are filled out.

Before creating a waybill, you must also fill in the data on the vehicle consumption rate in the fixed assets card. To do this, in the card, click on the go button, there is a register of information “ Settings for fuel consumption rates for vehicles and units».

The journal of waybills and taxation of waybills is located in the menu item " Material reserves" The program provides for filling out different types of waybills depending on the vehicle. Let's consider the design of a waybill for a passenger car (form No. 3).

On the " General information» information about the vehicle, driver, department, employee and organization at the disposal of the driver is filled in. The license card is filled out if the operation of the vehicle according to the waybill is a licensed activity.

On the " Departure» provides data on the vehicle’s departure time and speedometer readings at the beginning of the day. At the bottom of the waybill, those responsible for the departure are indicated.

Next, fill in the “ Routes» indicating the vehicle routes. After filling out the given data, the waybill is saved and printed out for presentation to the driver. The remaining tabs are filled in in the program after the vehicle is returned.

On the " Routes» additional information will be provided about the time of departure and return of the transport, as well as the mileage traveled. In the " Return» the date and time of the driver’s return, the vehicle’s speedometer readings, as well as those responsible for the return are indicated. Information about the receipt, consumption and balances of fuel and lubricants is filled in on the tab " Fuel" and at the end of the day, the result of the driver’s work for the shift in hours and kilometers traveled will be filled in in the tab " results" If necessary, you can also fill out the “ Other».

To register the write-off of fuel and lubricants based on the waybill, enter the document “ Taxation of waybills».

Basic information about the waybill, transport, driver and speedometer reading upon departure will already be filled in in the “ tab Waybill details" To approve the initial data on the next tab, you must select the fill button to reflect the route of the vehicle in accordance with the waybill and the rate of expenses per 100 kilometers.

The standard consumption of fuel and lubricants is used as follows:

Result = (0.01 * (Transport (basic) consumption rate x Mileage + Consumption rate for transport work) + Consumption rate for special equipment operation) x (1 + 0.01 x Correction factors) + Consumption rate for dump truck trips + Consumption rate for heaters/air conditioners, for warming up and idle time + (Mileage/Control value x Correction values).

On the " Calculation of fuel consumption» information is provided on balances at departure, arrival and actual consumption of fuel and lubricants. The actual consumption of fuel and lubricants is compared with the standard consumption calculated using the formula and data on savings/overconsumption is displayed.

Data for reflecting amounts in accounting are recorded on the tab “ Write-off of fuel and lubricants» - here the nomenclature of the material stock, unit of measurement, KFO, accounting account, KPS, MOL, account debit and the amount of fuel and lubricants written off are taken into account.

After selecting the standard operation " Write-off of fuel and lubricants according to waybill» document « Taxation of waybill» is recorded and posted, at the same time generating transactions for the write-off of fuel and lubricants.

Materials , budget issue, April 2018