Tekhanaliz MACD indicator. MACD indicator Histogram, description

The developers of terminals in which the magic conversion is actually transformation in money, try to ease the life of traders. A new more perfect indicator of building a graphic histogram MACD appeared. He helps to make a decision faster and more weigly and calmly.

The assistant program, independently builds a currency pair schedule in a separate window. The trader only changes the necessary settings, already when installing directly into the terminal. Now visually everything looks much clearer.

Indicator Description - MACD Histogram

The principle of operation of the new indicator remained the same. Compared with standard MACD, only some parameters have changed. There are new levels that are configured by an independent trader when installing. And in the calculations themselves, the so-called "" appeared. It shows the degree of histogram deviation.

For example, if the histogram columns go beyond this moving average, it will need to be taken into account with new transactions. In this case, the trend turn is not excluded:

The new version of MACD is perfect predecessors. Although it is also easy to use, as well as the classic version. But if you still do not really understand the subtleties of terminology, you will return a little back.

What is MACD? In Russian - this is the convergence of the most moving averages, which we mentioned above. The indicator itself developed an analyst D. Apple. His first work referred to the indicators of a market trend.

MACD histogram. Convergence and Divergence - Trade Strategy

Actually, in order to obtain the appelless indicator itself, three moving averages immediately took immediately. He needed the following data:

- EMA for 12 periods based on closing prices,

- EMA for similar 26 periods

- and the "fast" line, which is calculated by subtracting 12 periods from EMA 26 periods.

Also need an indicator of the "fast" line for 9 periods. It gives a "slow", signal line.

So, the formula of the new MACD indicator of the histogram turned out as follows:

Fast line (MACD) \u003d EMA (price, 12) - EMA (price, 26);

A red cross marked the line quickly, that is, the MACD, the slow line is shown in green. In order for the picture to look more clearly and understandable, the zero horizontal. If "fast" above the marker "0", then the trend is sent to the top. Accordingly, if lower zero is down.

More zero Quick line falls if, when calculating the first formula, EMA 12 will be greater than EMA 26. The data in the graph is highlighted in different colors for ease of perception. EMA 12 is depicted with an orange line, and EMA 26 is blue.

At the same time, the value of the "fast" line will \u003d the difference directly between "media".

Below zero "fast" falls in the event that the average 12 periods will be less than the average 26-periods. Then the difference between the average will turn out negative.

The graph shows the intersection points of the average, which correspond to the indicator "0" in the MACD line. Such intersections indicate the trader that it is time to open new transactions. If the slow line crosses the quick bottom up, you need to open a purchase. On the chart, these are points B, D. If the lines intersect from top to bottom, then open a sales transaction. These are points A, C and E.

The main thing to remember what is most profitable to buy, when fast from lines less than 0. But we will sell - when above. But if the trend starts, it is better not to work with MACD intersections, because it may be continued.

The signal of a possible intersection enters the program earlier than the intersection of sliding lines in the chart itself. So the time to open the transaction is enough completely.

However, it should not be assumed that the program itself will do everything for you. Graphs with the examples are taken randomly. They give out a real situation, and not excellent performance of the indicator. The main thing is that profits appear only when the lines intersect until the trend is opening. Losses are inevitable? If transactions are conducted in the so-called corridors. In the figure, this, for example, point V.

It is still necessary to wait for the end of the trend, open earlier. Analyzing will have a lot and painstakingly. By itself, work with the intersection will not bring profit. On the contrary, it can bring "in zero" or even "in minus".

What does the MACD histogram of the indicator look like?

It is worth noting that complement the program and other adjacent data. For example, the distance between our fast and slow straight line. This distance is changing. For simplicity of understanding, a MACD histogram is needed.

It can be easily built:

MACD histogram will be \u003d quick line MACD - (minus) Slow line of our MACD

Present such a histogram is better in the form of the following form:

Here, a set of vertically spaced rectangles whose width is fixed, and the height is the value of the MACD histogram. If there is such a need, you can increase visibility. For this value, you need to coefficient. For example, by 3. So the histogram columns will be higher, and the entire histogram is clearer.

Most often, in the figure of blue columns. When our fast line is more slow, the histogram will be with the "+" sign, that is, positive.

With an indicator above zero, its value displays the speed of the fast line of relatively slow.

And vice versa, if the rapid line indicator is lower than the slower indicator, we are dealing with a negative histogram. The histogram value indicates how fast below relative to the slow line.

If there is an increase in the histogram, that is, the preceding column below the next, the strength of the players to increase (they are called "bulls") increases. Moreover, regardless of whether the histogram is in the position above / below 0. The increasing transactions are opened instantly. The drop in the histogram, strengthens the work of the players to downgrade, the so-called "bears". So, enter the fight against a decline.

In general, all the values \u200b\u200bof histograms change to the autumn narrow corridor, the range is very small. But it is so easier to navigate when counting profits.

The MACD graph of the last period shows that the histogram almost did not go to extreme values. If this happened, this is the signal that the price has overcome a lot and it is rare for it. It is necessary to fix profits and wait to roll back to the side opposite. In terms of price movement is not worth it. Since the movement is unlikely to continue.

MACD indicator, detailed description

Created by the leading investment manager, a successful trader and the author of numerous publications by Gerald Apple, the MACD indicator based on the convergence / divergence) is perhaps the most unique tool in almost any Forex trading platform. MACD indicators can be simultaneously attributed to trend indicators, and to oscillators. The uniqueness of the MACD is that it is capable of generating trading signals both on the trend plots of the market and with lateral movement (FLET). In addition, the use of this indicator allows you to determine the potential movement of movement, as well as (with a certain probability) possible change in the direction of the market.

MACD indicator: description

To build MACD graphs, two methods are used - linear and in the form of a histogram.

Linear MACD is built on the basis of three moving averages, of which only two are displayed on the chart. Immediately the MACD indicator itself is the difference between two exponential sliding averages (from EMA with a smaller period, EMA is deducted with a large period). In order to get rid of random oscillations, the so-called signal line is used, which is a simple sliding medium (SMA). Moreover, it does not use the price value for its construction, but the difference between these two sliding averages, only with a smaller period. By default, the EMA values \u200b\u200bare used 12 and 26, and for SMA - 9.

Settings can be changed. In this case, an increase in values \u200b\u200b(for example, 21.50 and 12) prevents false signals, but does not allow the start of the market in a timely manner. Reducing settings (for example, 6, 13 and 5) makes the MACD indicator more sensitive to price changes, but leads to more frequent false responses.

To make it easier to recognize a change in the distance between the lines, a histogram is used, which is a difference between fast (MACD) and a slow (signal) line. When a fast line is located above the slow, histogram columns are from above from zero line, and vice versa.

It should be noted that in MT4 (MetaTrader-4), in contrast to the same Rumus, only a signal line and a histogram are displayed, the MACD indicator itself is not displayed directly.

MACD indicator signals

The crossing line of the MACD signal line in the direction from top to bottom is an explicit sale signal. In this case, the location of the histogram bars below the zero line only enhances this signal. The intersection of the MACD line of the signal line in the bottom upward direction, on the contrary, is a purchase signal, and the histogram is in position above the zero line is also a strong signal to open a long position.

The emergence of the contradiction between the indicator testing and the price schedule speaks of the divergence ("bearish" - if a higher maximum price did not find its confirmation with a maximum MACD - or "bullish", when no lower minimum is confirmed) and is a sign of a possible change in trend.

Disadvantages of the MACD indicator

And yet the MACD indicator is recognized as one of the most reliable technical indicators on the signals of it is quite simple for understanding and allow you to correctly evaluate the current situation and make a profitable deal in a timely manner even beginners.

Like many other MACD indicators use in their work a moving average analysis, pushing off from them to build their significant levels. The MACD indicator was designed and first introduced in 1979 by Gerard Appel. MACD is the abbreviation of the English Words of Moving Average Convergence / Divergence, which is a simple language indicates the "convergence and discrepancy of moving averages".

The popularity of this indicator is quite high, since MACD belongs to the oscillators group, generating good signals both with a strong trend and in the FLET. For trade, it can be used as an independent unit and in combination with other technical instruments.

Where to find MACD

Search the MACD indicator somewhere specifically in the network is not necessary, as it is included in the standard set of technical tools of any trading terminal. In MetaTrader4, it can be found and adding it to the price chart, selecting sequentially "Insert - Indicators - Oscillators - MACD".

Or you can simply find it in the Navigator window.

As you can see a list of oscillators in MetaTrader4 rather impressive, which has a logical substantiation, because the market, unfortunately, does not often demonstrate a strong prolonged movement in one direction. A lateral trend is more common in which all oscillators and MACD in particular, allow you to receive and use high-quality signals.

How to configure the MACD indicator

Thinking the MACD on the price schedule, the indicator settings window will open, in which you can see which major parameters are used to build a diagram. Before you configure the MACD indicator in accordance with your preferences, which love to make various experimenters, you need to look at its standard parameters.

In principle, the MACD indicator is built as the difference between two moving averages with a period of 12 and 26. Next to the resulting histogram, the moving average is built up with a period 9. All Moving Average used to closing prices. These settings are classic - they are developed by the author of this technical instrument and they still have not lost their relevance, so you can leave them unchanged.

How to read Macd.

Attaching the MACD to the price schedule, it can be seen that it is built directly under it, and the indicator diagram itself will represent a number of vertical lines that will be located above-below the conditional zero line. The first misconception, which is subject to many novice traders is that they perceive the size of the columns of this technical tool, as some parameters of growing and decaying volumes, although it is not at all.

In fact, the histogram simply shows the difference between the two sliding averages. That is, the MACD indicator works with two lines. Accordingly, if the difference between two sliding averages is growing, then the size and columns of the indicator diagram increase. That is, the more the gap between the two moving average, the further from the zero line the individual MACD values \u200b\u200bare removed, forming some extremes on their own graph.

In addition, it is easy to see that the intersection of the sliding corresponds to the indicator diagram intersection with its zero line columns. Accordingly, it helps to determine the existing trend without the help of moving average. If the MACD columns are above zero, then the tendency is ascending, if below, then, respectively, descending.

In addition, the screenshot presented above allows you to observe - when the difference between two sliding averages is constantly growing (the MACD columns consistently increase), then there is some strong trend on the market. In turn, when the histogram began to fall - we can talk about the correction of the downward trend. If the zero line is crossed, it means that it will correctly argue about the resulting high downward trend and so on.

In addition to columns, which are lowered and raised around the axis in the form of a zero line, the MACD indicator also contains a red dotted line. It is also called the signal. She gained his name for the fact that many traders based on her behavior are looking for points to enter and exit the market.

To help understand how to interpret the MACD signal line, it is enough to look at the screenshot presented above, where the most advantageous positions are clearly visible to open and complete orders.

In the first case, the signal line comes out of the histogram area above zero, which is a signal for sale. The same situation is observed in the second case, but the third circled circle indicates that the MACD dotted line leaves the histogram region below zero, which indicates the possibility of making a purchase transaction.

See also:

Also the signal line shows where the profit should be fixed and exit the transaction. This should be done as soon as she again cross with the MACD columns. The listed methods of interpretation of individual elements of the indicator belong to the easiest, but there are more complex (at first glance) to find signals that have significantly greater weight.

Divergence on MACD.

The strongest signals that should be perceived as a direct guide to action are divergence, that is, discrepancies between the price schedule and the MACD indicator diagram. In order not to confuse in terminology, it should be immediately understood that the divergence is a discrepancy, and the convergence for forex is a convergence or, as they say, rapprochement. Some analysts even call signals from MACD convergence, but it is not. Signals only gives divergence, and the convergence is simply often observed on the indicator, which actually always demonstrates or then, or another phenomenon, since the MACD indicator parameters track the convergence and discrepancy.

Divergences allow both to buy and sell. The above is the same signals that allow you to open Sell transactions. The most characteristic and strong is the first signal, where the price schedule demonstrates two consistent maximum formed, while the MACD indicator on the contrary - forms two consecutive minimum from its columns.

The second and third signal is weaker, but in most cases they still allow you to make a trading operation and to earn it well. The second signal indicates that the price of graph is growing, and the MACD histogram forms two consecutive vertices. The third signal is born when the double top is observed on the price program itself, and MACD demonstrates two highs, where the second is below the previous one.

The first signal for sale on MACD

To be clearer, you should appeal for help to screenshots. The image presented below is clearly seen how two consecutive local maxima were formed on the price schedule, while the MACD indicator diagram does not confirm these peaks - opposing them with two descending vertices.

Since there should be no particular problems with the definition of this signal, it should be disassembled in more detail when the transaction should be opened. That is, where the entry point is recorded. Most traders and analysts say that as soon as the divergence itself has been outlined, you can already sell. This recommendation can be found in almost any literature dedicated to MACD.

But some experts are still advised to eliminate ambiguity to use the previously considered MACD signaling line. That is, as soon as the dashed line of the indicator leaves the area of \u200b\u200bits histogram after the second peak, you can immediately "go to short" (open the Sell order).

How to eliminate false signals on MACD

Since this indicator is still an oscillator, then you do not need to forget about its vulnerable place - when a strong trend is observed on the market, the signal line can form a number of false signals. To weaken their influence and eliminate the opening of unsuccessful transactions, you need to follow two simple recommendations:

- follow the global trend, that is, if an upward trend is recorded on the daily chart, you can ignore the signals for sale in smaller timeframes, so as not to enter the market against the trend, since it usually does not end with anything good;

- apply MACD in combination with the theory of technical analysis, considering the possibility of making a transaction on a signal after building supports and resistance lines or after finding a confirmation of graphic models (head and shoulders, double top and so on).

The note should be taken to the note that when determining the divergence on the MACD, the line is built at closing prices, and not by HIGH points. In addition, when searching for a signal for sale, it must be borne in mind that the histogram must necessarily be higher than zero.

MACD SALE SIGNALS

The same signals and rules on the analogy method can be applied and when searching for purchases. It is usually said in this case about the MACD convergence, since the sliding lines come cloud. In general, this is the correct thesis, but in the mass of its traders do not make this difference, but simply talk about the formation of divergence for the purchase.

Again, in this case, the MACD histogram must necessarily be lower than zero, where its serial peaks become closer to the zero mark or form a double bottom in the second case (signal in the middle in the screenshot). The price should demonstrate two local minimum, where the second is below the first.

As an example, you can consider the presented screenshot, where it is clearly seen how the price on the downlink showed two consecutive peak and the second set a new local minimum. At the same time, there are also two vertices on the MACD histogram, but the second was formed above the previous one.

For greater confidence in the placement of the purchase order, the formation of divergence with some viewing levels of support and resistance or identify classic graphic models, well known to everyone who studied the basics of technical analysis.

Additional MACD signals

Using only alone divergences on MACD is, of course, it's good, but this is a very narrow look at what can give this indicator to an inquisitive trader. The fact is that, both at the price chart and on the indicator diagram, you can also search for graphic models. Moreover, it is necessary to pay attention to the attention that these additional signals also are also worked out very well in the overwhelming number. To explain this thesis, you can give an example from the history of the AUD / USD pair of watch schedule.

Signal for sale

If you look only on the price behavior, it is difficult to identify some kind of order that you can use the trader in your own interests. There are no bright pronounced signals of the turn, but in the end - the change of trends has yet occurred, and she could give a serious profit of everyone who could recognize the readiness of quotations to change the direction of movements in time.

However, if you look at the MACD indicator diagram, then there is clearly seen - the columns of the histogram draw a very visual figure of the turning "head - shoulders". It is truth to say, it is quite rare to meet such figures on the indicator, but each of them has great potential, so it is extremely important to know and track such additional signals from the MACD indicator.

You can use such signals as a guide to action can be immediately as soon as the signal line breaks away from the MACD histogram columns.

Purchase signal

The same, but exactly the opposite, draws a MACD diagram on a clock chart of a USD / CAD currency pair. The histogram columns show a classic inverted figure of technical analysis "head - shoulders", the entrance to the market is carried out when the signal line is separated from the indicator columns, and the profit fixation occurs when it is returned to them.

.png)

Trend Lines

In addition to the figures of graphic analysis, you can track on the MACD indicator diagram also and the trend lines, which will help take a useful solution and increase your capital.

In the screenshot, it can be seen that the Trend Line, conducted through the lower extremum of the MACD indicator gives the trader a reliable level of support and the price, touching it, knocks off, rushing up.

Outcome

So, after examining this oscillator carefully, it should be absolutely clear that the MACD indicator shows and how to use it in its own interests, adjacent to a new price movement to extract from him a little profit. All signals that MACD generates are quite easily distinguishable, and most of them, as mentioned above, works very well. Based on this technical tool there are many strategies, although MACD can be used as an independent element of the trading system. At the very least, the potential for this he is very large, although in this case a certain experience is required to avoid common errors allowed by newcomers.

Each trader early or later begins to experiment with technical indicators, trying to find the "that" that will allow you to open transactions, at a minimum, with 100% profitability. Often, the result of such research becomes a schedule, the signals of all sorts of "supergustable" indicators so much that resembles paintings by abstractionists.

The best - the enemy is good, and unfortunately, many classic indicators become forgotten, although their effectiveness is not inferior, and sometimes even superior to all Forex Gracia. Today we will talk about one of these indicators, namely, MACD.

MACD - indicator for beginners

MACD indicator is Abbreviation, deciphering as Moving Average Convergence Divergence, which is translated as an alignment of the discharge of moving averages. Its name is correctly pronounced as "Em Hey Si Di", although Forex in the Russian-speaking segment you can find the McDie slang name. The MACD indicator was invented in 1979 by Trader Gerald Apply for trade in the stock market, then, like many other indicators, "Having changed" to the forex currency market.

MACD is, in its own way, a unique indicator, because it combines the qualities of a trend indicator and an oscillator. With it, it is possible to determine the further direction of the price, the potential strength of the price movement, as well as the points of the Trend possible turn.

Application in the moving average indicator and smoothing the obtained signals led to the MACD characteristic of trend indicators of quality - lagging signals. It is unlikely that this can be considered a significant disadvantage. - This is definitely bad, for trend trading - on the contrary, since it allows to drain noise and false movements.

Along with this, MACD is a leading indicator that is inherent in oscillators, and allows you to pre-identify the points of price reversal.

Another very important point - indicatorMACD. perfect fit. The qualities of the trend indicator will not give a newcomer to trade against the trend, and the qualities of a leading oscillator will enable the deal at the very beginning of the trend and close the transaction at the time of its end.

How to install the MACD indicator on the schedule?

MACD is the standard MetaTrader platform indicator 4. To install it, you need to go to the "Insert - Indicators - Oscillators - MACD" tab.

After that, the indicator settings window will appear. While we leave the standard settings and return to them a little later for a detailed parsing.

As a result, we get the MACD indicator on the chart in the following form.

Indicator parameters

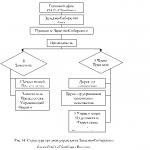

Consider the parameters of the MACD indicator in more detail. As it is clear from Figure 2, to configure the indicator, you must specify periods for three moving averages and at what price to build them.

A fair question arises: if only moving averages are specified in the indicator parameters, then where do these blue columns come from in the basement? This is the essence of the MACD indicator. To understand it, we will install two exponential moving averages with periods as in the MACD indicator, that is, 12 and 26.

As can be seen from Figure 4, the height of the bar of the histogram corresponds to the distance between EMA 12 and EMA 26. At the same time, if a faster moving average (in our case, EMA 12) is above a slower (EMA 26), then histogram columns will be above the zero line. MACD indicator. Otherwise, histogram columns will be below the zero line.

When crossing two moving averages, the MACD indicator histogram will react with the intersection of the zero line from the positive zone to the negative and vice versa. That is why the indicator is the convergence of the sliding average.

And where does the red dotted line come from? This line is sometimes called the signal. There is an erroneous opinion that this moving average smoothes the price. In fact, this line is an average histogram value. That is, the last bars closing prices are taken (default 9) and their average value is calculated.

How to configure MACD settings?

By default, we obtain the MACD indicator with parameters 12, 26, 9. By changing these parameters, you can adjust the speed of the indicator reaction to change the price and the frequency of the trading signals. We will look at two options - an increase and reduction of parameters.

- Increasing MACD indicator parameters

With increasing parameters, the MACD indicator will feed the trading signals less often, and will also filter false signals. However, sometimes it will lead to the fact that the indicator will not respond to the beginning of some potentially profitable price movements.

- Reducing the MACD indicator parameters

When decreasing parameters, the opposite effect will be directly. The indicator will become more sensitive to the price movements, the trading signals will appear more often, however, the number of false signals will increase.

What trading signals give the MACD indicator?

Now it's time to go to the most important thing - what trading signals will give us an indicatorMACD.. So, MACD can give four main trading signals.

1. Determination of the direction and strength of the trend

If the histogram is above the zero line and the maxima of the histogram columns are consistently increasing, then the market has an upward trend. Accordingly, a mirror situation occurs for the downward trend. This method of determining the trend during the periods of Daily and older was proposed by Alexander Elder in the "Three Screen" strategy.

In addition, this method allows us to evaluate the strength of the trend. The logic of the process is simple. The larger the distance between the sliding averages, the higher the histogram column, and, accordingly, the trend is more stable.

Fig. 5. Definition of trend

2. Local minimums and histogram maxima

The formation of local lows and the maxima on the histogram indicates that the price begins. Please note that the price reversal cannot be determined by the indications of only one indicator, it must be confirmed by other signs.

Fig. 6. Start of correction or price reversal

3. Crossing MACD with zero line

As we wrote above, the intersection of the zero level histogram corresponds to the intersection of moving averages, which in classical trading is interpreted as a signal to enter the market.

That is, if the MACD histogram crosses the zero level from top to bottom - this is a signal for sale if the bottom up is a purchase signal.

It is worth noting a very important point. Among traders there is no definite opinion. Some consider this trading signal with the strongest that can be obtained from MACD. Some traders argue that trade at the intersection of moving averages is complete nonsense. We believe that this method will only work with the correct selection of the parameters of the indicator and the timeframe used in addition to confirmation from other indicators.

Fig. 7. Crossing a zero level histogram

4. Use of divergences

Forex divergence is The discrepancy between the direction of the price and the direction of the indicator, which is interpreted as a prerequisite for a rapid trend.

In the case of MACD, the divergence is determined between the prices of the price and consistently rising or lower histogram columns. Note that histogram peaks are considered only above or only below the zero level. When crossing the zero line of the histogram, the divergence is considered discharged.

One of the most popular technical analysis indicators in the world is MACD, which is decrypted as moving average convergence / divergence (convergence and discrimination of moving averages).

This wonderful tool created by Gerald Apply (Gerald Appel) knows every trader by any assets, from gold to stocks, futures or, of course,.

Most of the super-supersay and easy-to-use indicators were created with steep traders who earned their millions with their help. In this regard, the history of the appell is very indicative.

MACD Creator

The McCea Indicator was created by Gerald in the distant 1979. But Gerald did not immediately become such an advanced dude. In fact, initially he worked ... psychoanalyst. In addition, he was also a very famous photographer. In short, a very creative person.

And here is the knowledge of human psychology and helped him create one of the most successful indicators in the history of finance. To a considerable surprise of the author himself, who did not assume that his brainchild is waiting for such a brilliant future.

Here is such a dude. The form is a typical psychoanalyst (hehe).

But, apparently, the work of a psychologist with nervous housewives did not bring enough income, and Gerald hit all the grave. And very successfully - a millionaire, author of more than 15 books, a generally recognized expert of technical analysis. In short, the typical path of a successful trader and client assets manager. The owner of two investment companies.

By the way, it is alive and still works with shares, options, stock investment funds (ETF) and the like. Man is a success. And all thanks to its indicator. If we can't create your own - let's use what is done before us.

Brief history macd.

Who are these people who created the indicator that conquered the trader world?

- In 1979, Apprel created an indicator that became the MACD lines.

- In 1986, Thomas Aspray added a histogram to MACD.

Thanks to Thomas, the indicator has become even more accurate. The histogram supplemented the intersection of two lines - the main MACD signal.

To open the indicator, click the button Indicators. and select MACD..

Well, the story figured out, to the case.

Formula

As always, I look at the formula with one eye. Yes, in live chart, it is automatically calculated, but to have a general idea of \u200b\u200bwhat we use does not hurt. Indicators of this class as MACD are always based on a moving average.

Lines in the indicator, strictly speaking, two. Plus, there is also a histogram.

- Macd Line: EMA 12 days - EMA 26 candles.

- Signal line: EMA for 9 candles.

- bar graph: MACD line - signal line.

As you can see, nothing complicated.

Description MACD.

The indicator is very simple - it is not surprising that he is so popular. Well, who loves the brainstorming tools, after which you do not know, whether to cry overvraper, whether to beat your head hysterically? With MACD everything is much easier. The principle of using it is shown in the figure below.

The indicator has only three simple components:

- mACD line;

- signal line;

- bar graph.

Briefly about each.

Macd Line

This line is very simple. A long medium sliding (EMA) is taken and deducted from the shorter EMA. Long, as a rule, is 26 days, short - 12 days. However, no one bothers you to specify your own meanings.

Signal line

This is an EMA from the MACD line. Here you too can choose which length should be the average sliding. As a rule, this value is 9.

bar graph

As the price is developed, the distance between the MACD line and the signal line will change. This is the histogram. Her task is to indicate exactly two MACD lines are far or close from each other.

In addition, the histogram may be higher or below the zero (basic) line. And when the histogram above is the price, as a rule, goes up. And vice versa. Below? The price falls.

The general principle of use is as follows. When the histogram is above the zero line and its value increases, it means that the price grows. And on the contrary - if the histogram is under zero line, the price drops.

Strategy

Macd has only 3 situations that we need. It:

- the intersection of the signal line;

- intersection of the zero line;

- divergence.

Now briefly consider each of them.

Intersection of signal line

This is the most popular, relevant and in demand (how many advantages) MACD indicator signal. Remember that the signal line is in fact, is an indicator for the indicator. Therefore, the signal is always somewhat lagging behind the MACD line.

Therefore, if the MACD line crosses the signal line - wait for a sharp change in the price up or down. To learn how to use the indicator correctly, you need not only to detect the intersection, but also try not to fall on false signals. It is not difficult and comes with experience.

In the examples, the MACD line is highlighted in blue. Signal line - red.

This is essentially the main signals of the indicator:

- mACD line crosses the signal line from below: the price is ready to go up;

- the MACD line crosses the signal line from top to bottom: the price is preparing to go down.

And here is on the real example.

Crossing zero line

Well, this is another signal. In this case, the MACD line crosses the zero line and always goes up either down.

- If the MACD crosses the zero line from the bottom up - the course will go up.

- Crossing the zero line from above down - the course will go down.

Divergence

Divergence with MACD is no different from that for. The principle is absolutely the same. If MACD goes up, and the price is down, then listen to MACD: the price will change and also go up.

Positive divergence (price up)

For example, in the figure below, we see that the price for the arrow dedicated the period falls, but MACD, on the contrary, seeks up. The rights indicator and sees the situation in advance - the price will go up. So happens.

Negative divergence (price down)

The same eggs, only in the profile. MACD strives down and soon follows the price.

MACD trade in binary options

As you can see, the indicator MAKDO is not only simple, but more than effective. In essence, this is an indicator and strategy in one bottle. It not only allows you to identify the trend, but also will help determine the strength with which the price is moving (the so-called "momentum").

Use MACD only on the market with good volatility. It's when the price is "sausage" according to the schedule: it is taking it up, then down. If it turns into one place and moves the Welcome - the asset ignore and find another.

How to trade it? Look at the intersection and on divergence. Especially for the last - it is the divergence that always shows the change in the trend. This is a great signal.

Do not forget to look at the behavior of a currency pair or another asset in different timeframes and, based on this, adjust your strategy.

Golden moment in binary options - of course, the intersection of lines. The main thing is not to be mistaken with the expiration time.

- If you work with a 5-minute schedule - put expiration for 5-25 minutes (my favorite interval).

- An hourly timeframe - expiration is good at the end of the day.

- Well, a 1-minute schedule only for short-term turbo options for 1-3 minutes.

Are there any deficiencies?

Of course, despite all its advantages, there are McDie and certain disadvantages. But they are exactly the same as any other indicator. Blindly trust the indicator is impossible. No indicator gives 100% of successful deals. It is necessary to consider it only with the analysis of price movement.

You must understand whether the price is moving up, down or is located in the side movement. Use different timeframes, evaluate the situation as a whole. And only then rely on MACD. In addition, it is not particularly desirable to use it on a 1-minute chart. However, this refers to most trend indicators.

With proper practice, MACD will show wonderful results - it is created, therefore popular. But be patient, practice does not approve of fuss.

How to configure macd.

To adjust the indicator, click the icon in the form of a gear.

A window with three tabs will open. All settings are made on the first tab - Inputs..

Change these parameters is not necessary. By default, there are typical options that are suitable for any currency pairs or shares. Nevertheless, briefly go through the main indicators.

- Fast Length.. The short EMA period. Default 12 days

- Slow Length.. The period is long EMA. By default, 26 days.

- Source. It is indicated what price of the candle is used for calculations. By default, Close is the closing price.

- Signal Smoothing.. The time period for the signal line. Default 9 days.

- SIMPLE MA (Oscillator). Strong smoothing graphics. Good for big timeframes.

- SIMPLE MA (Signal Line). Small correction of the signal line.

No one will hit you by hand if you duck in different parameters and see what changes. But - not too much with this. You need to practice, not attempt to find super-parameters that will immediately make you rich.

Menu Style. and Properties. - Standard for schedule. In the first one can change the color of the lines and histograms, in the second to improve the display of the indicator. You can touch anything - no significant changes.

Here is such it, the MACD indicator, he is MacDi. Cool, convenient, proven decades of trade. Add support / resistance lines to it and get an excellent tool with which you can achieve excellent results.