New York Stock Exchange (NYSE) in detail. New York Stock Exchange

NYSE The largest stock exchange in the world and the second largest companies in Listing. The New York Stock Exchange consists of five large trading halls, in which trade in shares. Exchange is a symbol of the financial power of the United States and the financial industry in general. Compounds with listing of shares on NYSE are about 333.

Working hours

The trading session opens at 9:30 and ends at 16:00 local time.

Indexes

The world-famous Dow Jones Index for Industrial Companies, as well as Nyse Composite and NYSE ARCA TECH 100 Index and NYSE ARCA TECH 100 INDEX are determined on the stock exchange.

Doe-Jones is the oldest among all American market indexes. It was created to track the development of the industrial component of American stock RVNs.

The index covers the 30 largest US companies. The "Industrial" prefix is \u200b\u200ba tribute to history - today many of the companies included in the index do not belong to this sector. At the beginning, the index was calculated as the average arithmetic price for shares covered companies. Now, a scalable average is used for calculation - the amount of prices is divided into a divider, which changes whenever the shares included in the index are exposed to crushing or unification. This allows you to maintain the comparability of the index, taking into account changes in the internal structure of the shares

NYSE ARCA TECH 100 INDEX is another American stock index. It is calculated on the NYSE, but it includes companies whose shares and ADR are listed on other American stock exchanges. Innovative companies from various industries include the index: production of computer equipment, software, semiconductors, telecommunications and medical equipment, biotechnology, defense and aerospace industry

NYSE COMPOSITE is one of the most popular stock indices in the world. It reflects changes to the course of all shares that are listed on NYSE, including more than 2,000 largest companies registered in both the United States and in other countries, with a total capitalization of more than 20 trillion dollars.

NYSE COMPOSITE is an excellent indicator of the state of the US economy. The NYSE Composite index is the average value of the stock exchange. While the Dow Jones group indexes are measured in points, NYSE Composite is measured in dollars.

Bargaining

Currently, the NYSE stock exchange is traded by shares of about 2800 companies, in most cases the NYSE shares are "blue chips" and fast-growing companies. For trade on NYSE, all companies must meet high listing requirements, as the Exchange is constantly working to preserve its high reputation, offering for trade extremely strong and reliable shares.

Major bidders are specialists and brokers. As a rule, NYSE brokers are employees of investment companies, they trade either on behalf of customers of their company, or on behalf of the company directly on which they work.

History of Exchange

The New York Exchange was founded on May 17, 1792 after signing Agreement 24 New York brokers called "Buttonwood Agreement" on creating a New York Stock Exchange. For the then brokers, it was a great way to limit its deductions on a commission during trade.

The New York platform for the exchange of shares on an ongoing basis has begun its work since 1817. In 1853, the concept of listing of shares appeared on this site. From now on, the company that wanted its shares to be quoted on NYS & EB should have complied with the conditions of capitalization. The name that, by the way, exists now from the Exchange, appeared in 1863.

After 1929, serious changes occurred in the US Exchange Trade. The collapse, which happened in the securities market, as a result of which the volume of trading and investment in securities has declined greatly. Private faces were in no hurry to invest their money in stock, believing that there is no full warranty to make a profit. Next, followed by twenty-year calm on the US stock exchanges. Companies stopped trying to attract ordinary citizens as investors, and due to court proceedings and inspections, many advertising campaigns to attract capital were either shortened, or collapsed.

Only in the early 50s, exchanges found a way to activate their activities to attract investors. In the New York Stock Exchange was created a "strategy of four precautions", which was based on all advertising shares of the company.

In September 1987, the place on the NYSE Exchange was worth about $ 1.15 million, this gave hope for good market development prospects. But, after the Black Monday, September 19, 1987, still changed. On this day, the Dow Jones index fell by 22% - record importance in the history of trading. To prevent such incidents, precautions were taken, one of which was the rule of bidset, with a decrease in the index by more than 10%.

In March 2006, the New York Stock Exchange signed a merger agreement with Archipelago Holdings and offered its shares to potential investors, thereby becoming a commercial organization.

In early June 2006, the media appeared information about the future merger of the NYSE Exchange and the Euronext European Stock Exchange, which eventually took place on April 4, 2007.

The New York Stock Exchange (United With Euronext in 2007) is the largest organizer of the world in the world: through its infrastructure there is one third of the world's total transactions with shares. The Group is represented in 55 countries of the world, its largest business units are NYSE, Euronext, Paris, Brussels, Amsterdam Stock Exchange, International Futures Exchange in London, Clearing Organizations, Electronic Bidding Platage NYSE Arsa, etc. In essence, this is a global international corporation. With capitalization more than $ 5 billion.

The NYSE EUROEXT group fully controls the entire process of maintaining conclusion of transactions: the company included in its structure carry out stock operations, clearing, accounting and storing securities. The group's revenue in the third quarter of the current year amounted to $ 848 million, and the net profit of $ 108 million.

Location: New York, USA

Again I am glad to welcome you in my blog!

Speaking about the venues for the turnover of shares, it is impossible to bypass the largest world stock exchange - NYSE (The New York Stock Exchange). In Russian, her name sounds like the New York Stock Exchange. She is also one of the oldest - she is more than two hundred years. This is a kind of symbol of American power.

I have no doubt that everyone is interested to know how all this began, what events survived the stock exchange and how hard time cope. Let's see!

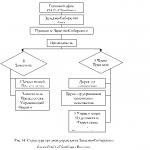

The structure of this wonderful institution is better to present in the form of a table:

History NYSE.

In 1792, 24 brokers decided to unite and signed the so-called Boottonvian Agreement on the establishment of the New York Stock Exchange (NFB). This name was purely nominal, since all trading, as before, was conducted in the coffee shops. There was not even a highlighted building. Trade was carried out in the old manner, mostly barter transactions.

The first securities for trading on the NYSE stock exchange became the shares of the famous The Bank of New York.

In 1817, the representatives of The New York Stock Exchange visited their competitor - the Birja of Philadelphia. This visit to the circumstances initiated the initial reorganization of the NYSE Exchange:

- Trade moved from the coffee shop itself in the Exchange Building.

- Auctionists were admitted to the trading sessions, that is, in essence speculate securities.

- The first constitution appeared.

But a truly institution captured the leadership after the invention of the telegraph in 1840. NYSE New York Stock Exchange is the first one who applied a useful innovation in trade. It helped to raise the quality and speed of paper circulation to a new level. NYSE rapidly gained popularity, the number of traders grew like a snowball, and in 1869 they had to even limit them.

The first ticker (short designation) of the action appeared in 1867.

Reorganization and merger

By the beginning of the twentieth century it became clear that the stock exchange should grow and strengthen its position, since all the prerequisites for this are. Then the guide fell on the path of reorganization and mergers.

In 2006, after a series of mergers, NYSE formed the world's first intercontinental stock market. As a result, there was a complete rejection of traditional work in favor of electronic trading.

Since then, trade is carried out in fully automatic mode. Exception is made only for the rarest or very expensive shares.

NYSE EUROEXT tried to absorb the German Deutsche Borse, but in Europe reacted to this intention to be extremely negative - no one wants to allow the emergence of a monopolist. However, NYSE managed to purchase InterContinental Exchange in 2012, as a result, the head exchange was disconnected with Euronext.

Currently, NYSE brings together the 6th Exchange Trade Exchange, located in 5 countries and 6 exchanges for working with derivative financial instruments (such as: futures, options, etc.)

How NYSE works

Above, I mentioned that the auction is now being carried out on a completely e-based basis, so it does not have to follow its specialists every second to the change in courses and shout out their proposals, as we used to see in American films.

Thanks to this system, millions of traders can trade online directly from home. To do this, only special software that allows you to conduct trading.

Organization of trading and licensing

There are 1366 people on the stock exchange - this number is consistently over 60 years. Among them:

- Commission brokers - 700 people.

- Brokers in the hall - 225 people.

- Specialists - 400 people.

- Exchange brokers - 41 people.

Previously, they sold the places themselves, and now you can buy a license for the right to occupy one or another place on the stock exchange for a period of one year.

Exchange participants are also traders who trade under the license of their broker.

The main feature of the trading on the largest stock exchange of the United States has become the absolute transparency of all operations. With the help of special programs, you can track the story of any action of each bidder. NYSE is rightfully proud of this indisputable advantage.

Its activity is controlled by the Securities and Exchange Commission.

Features Trade Scheme - Crisis Limiter

The NYSE affairs did not always go uphill. Crisis in the American and global financial markets, as well as the most significant events of other thanks able to withdraw from equilibrium any trading system.

The first serious shock of the Exchange was tested during the global economic crisis of 1907. Capital outflow exceeded all imaginable scales.

In 1929, the famous October Tuesday. The stock market literally collapsed, because of which there were many cases, when the broken traders ended the scores with life.

The year 1987 was marked by "Black Monday", when the Dow-Jones index showed a phenomenal in the entire history of the fall - by 22.6%.

After that, it was decided to introduce the so-called switch, which stops all the operations on the stock exchange in the threat of a strong negative impact on the stock market. This system is fully automatic, activated when performing certain conditions.

The switch has already worked in several cases:

- Dow-Jones fall in 1997 by more than 7%.

- As a result of the attack of terrorists in the United States in 2001.

- 2010 - again the fall of Dwu Jones, this time by 10%.

- Due to the natural cataclysm - Hurricane Sandy in 2012 (for a period of 2 days).

- Panic on rumors about the preparing attack of hackers on NYSE (which never confirmed).

The system has shown reliability in preventing stock exchange collaps and has become an example for other exchanges.

How to stay on the stock exchange

By no means every issuer receives the right to place its securities on this site. The NYSE Exchange "makes the weather" on the global stock market, so strictly comes to the selection of candidates.

The one who wants to place assets on the court must match the listing - special requirements developed by NYSE. These include:

- The number of shares on the market.

- Annual profit.

- Minimum two-year income.

- The number of shareholders of the company owning more than 100 shares at the same time.

- The cost of company assets.

- Trading volume.

At the same time, the exchange accommodates more than 4 thousand issuers in itself (most of the American shares). This is 60% of the world turnover of securities. It is not surprising that traders from all over the planet are so closely followed.

Pros and Cons NYSE

Like any trading platform, even such a monster has the pros and cons.

Pluses are as follows:

- Reliability - long-term history and high reputation allow NYSE to be considered a leader in this area.

- Access to stable and promising securities.

- High Software Software - Online Trading On this US Exchange Trader orders are performed for a split second, which allows you to confidently predict profits.

- Absolute transparency of work.

- To a lesser extent (compared to other sites) is subject to significant variations of quotes.

- Convenient for European Russia Trading Time.

But there are some minuses:

- Tangible commissions.

- At times, sharp jumps of quotations.

The most famous shares traded here

If you even list the top companies with access to the placement on the stock exchange, it will be for a long time. We also mention that among them there are:

- American Express Co. (AXP) (credit services).

- AT & T (T) (Telecommunications).

- Boeing Co., The (BA) (aircraft and defense).

- Caterpillar, Inc. (CAT) (agricultural and construction equipment).

- Cisco Systems (CSCO) (Telecommunications).

- Chevron Corp. (CVX) (Oil and Gas Company).

- Coca-Cola Co. (KO) (drinks).

- Exxon Mobil Corp. (XOM) (Oil and gas company).

- GENERAL ELECTRIC CO. (GE) (industrial conglomerate).

- THE GOLDMAN SACHS GROUP, INC. (GS).

- IBM. (IBM) (computing).

- JPMorgan Chase and Co. (JPM) (Financial Group).

- Johnson & Johnson Inc. (JNJ) (Chemistry, pharmaceuticals).

- McDonald's Corp. (MCD) (quick service restaurants).

- Nike Inc. (NYSE: NKE) Pfizer, Inc. (NYSE: PFE) (Pharmaceutics).

- Procter & Gamble Co. (PG) (household chemicals).

- Verizon Communications (VZ) (Telecommunications).

- Visa, Inc. (V).

- Wal-Mart Stores, Inc. (WMT) (trading network).

- Walt Disney Co., The (DIS) (Entertainment Industry).

How to get access to trade

In order to work with NYSE, the trader will need to conclude an agreement with a broker that has a license to access this site. This can be both a Russian broker and under the jurisdiction of the United States. However, carefully check the authenticity of the license, so as not to be in the hands of fraudsters, which are especially many around this exchange.

Broker provides software by which you can access directly on the stock exchange and immediately start trading. Then everything depends only on your skill.

Many believe that a huge deposit is needed for trading on the court. However, this is a myth, for work there will be enough starting capital in 1000-2000 US dollars to open an account in foreign brokers. Some of our brokers will open from $ 200, the only question is that you will do with such a small deposit.

INTERACTIVE BROKERS CAPTRADER EXANTE JUST2TRADE

In fact, the only real major American broker, which still works with the Russians.

- There is support in Russian

- Good commissions

- Deposit can be replenished with rubles (by currency control)

By cons byway:

- Minimum deposit of $ 10,000

- Commission for inactivity

The company is the American "daughter" finama and created to bring clients from the CIS to the American market.

- The maximum simple account opening

- Russian-speaking support

- Opening an account from $ 200

- Pretty high commissions

- Different kind additional payments

CAUTION ON BINAR Options and Forex

I consider it my duty to clarify some moments.

NYSE is a stock exchange. It trade with shares, bonds and options. It has nothing to do with Forex - on it, as you know, traded only currency. And certainly does not apply on the world giant any binary options that are no other, except electron casino, are not.

Therefore, I really hope that none of the network fraudsters who divorced a great set, to my great regret, will not seduce you with light gain and "win-win" strategies. They began to cover NYSE very often as the most popular platform. They even assure that they provide online quotes on the schedule, as well as real market movements.

Always separate flies from the kitlet. Trading is speculation, it is breeding, and I am not very configured to discuss him. And investments are a long-term and reliable strategy of additional income, which is very possible with the help of NYSE, but only with planning horizon from 3 years.

As they say, "be careful and careful."

Excuses of exchange

It is here that the main indexes are presented, followed by the whole world. The trend of stock markets planet depends on them.

Dow Jones Industrial Average (DJIA)

It is the quotes of shares of the 30 largest US companies. He is the oldest and most significant stock index of America. Shows the state of the industrial industry of the United States. Calculated in points.

S & P 500

Reflects the state of the American economy as a whole, as it includes 500 companies with the biggest capitalization.

NYSE COMPOSITE.

This is one of the most popular indexes of the stock exchange, a weighted value of the value of all shares traded on it. Includes more than two thousand companies with registration both in the USA and outside the country. Also relates to the oldest indexes.

NYSE ARCA TECH 100 INDEX

Very interesting and equally well-known index, reflecting the shares of the largest companies in the field of innovation. Representatives are collected not only by NYSE, but also other American stock exchanges. It includes companies from the leading sectors of the economy. Unlike Dow-Jones, NYSE ARCA 100 is calculated in US dollars.

NYSE US 100 Index

The indicator includes 100 largest companies on capitalization whose paper traded on the stock exchange.

Prospects for investment in these indices

All NYSE Exchange indexes are marked with stable perennial growth. Of course, their history included falls too, but according to the results of the movement of quotations, they relate to one of the most promising world indices.

No warren Buffett, an unconditional expert in business and investment, which has an S & P 500 index in his investment portfolio, bequeathed heirs in no means to sell it, because he can provide them with a comfortable old age.

Therefore, any of them, as well as all in aggregate, can no doubt recommend to work - a reasonable investor never scores such promising tools.

New York Stock Exchange (Eng. New York Stock Exchange, NYSE) - the main stock exchange of the United States, the world's largest in terms of circulation. It is a symbol of the financial power of the United States and the Financial Industry in general.

The New York Stock Exchange is the largest in the world in terms of capitalization, more than 60% of the shares of the world's largest companies are concentrated on it. NYSE is the most liquid, i.e. The speed with which you can conduct an operation, whether it is a purchase, sale, or a game of a decrease, is measured by shares of a second, the stock exchange is least exposed to sharp fluctuations in stock prices.

In the New York Stock Exchange, more than 3,500 corporations from around the world are quoted. It defines the world-famous Dow-Jones index for shares of industrial companies (English Dow Jones Industrial Average).

The building of the New York Stock Exchange is located on the famous Wall Street Street. The NYSE trading platform consists of four trading rooms used to facilitate trade. The fifth trading room, located on Broad Street 30, was closed in February 2007. The main premises occurs opening and closing a trading, the rest provide brokers a place for more than 48 thousand square meters. feet. The NYSE Stock Exchange ranks first in the world in terms of trading volumes and the second largest companies in Listing.

Now the New York Stock Exchange is a family of exchange platforms located in six countries of the world. In addition to the main platform on Wall Street, it also includes:

NYSE EUROEXT - the largest market for eurozone cash securities,

NYSE ALTERNEXT - Pan-European market, with specialization in companies in developing countries.

NYSE has always actively opposed any intervention from the state into its activities, tried to always retain the status of a "closed club" and defended the regulation of the exchange of the Exchange by the members of the Exchange. But, despite this, two directions of regulation were formed - this is regulated by exchanges and the state.

History of the New York Stock Exchange

On May 17, 1792, twenty-four brokers who traded securities signed an agreement to trade only with each other. It was called the "Agreement underlaith", as it was signed under the planegmen in the area of \u200b\u200bWall Street Street, where brokers informally met. This date is considered a day the founding of the New York Stock Exchange.

In 1817, the Constitution of the Council of the New York Stock Exchange was adopted.

In 1863, the stock exchange received its name - New York Stock Exchange (NYSE).

On October 1, 1934, the Exchange was registered as a National Stock Exchange by the US Securities and Exchange Commission.

Since 1975, he became a non-profit corporation belonging to its 1366 individual members (this number is invariably since 1953).

In 1977, foreign brokers were admitted to NYSE.

In 2006, the NYSE ARCA is created as a result of the NYSE and Arcaex association and a public commercial company NYSE Group, Inc is being formed;

In turn, the NYSE Group merges with Euronext, creating the first transatlantic exchange group.

In early March 2006, NYSE completed a merger with the Archipelago Holdings e-exchanges and for the first time during his history offered shares to investors, thus becoming a commercial organization.

NYSE structure

Manages the New York Stock Exchange Board of Directors, consisting of 27 people. Three, Chairman, Executive Vice, the Chairman and the President, enter it due to the position being held, and the remaining 24 are chosen from among the actual members of the Exchange for a biennium. The Chairman is elected by members of the Council and cannot be a member of the Exchange or to engage in brokerage or dealership operations. He appoints the president and other officials of the Exchange. Selected members of the exchange 24 director divide equally in two categories:

- Directors from securities operations firms

- Public director who are not engaged in brokerage or dealership operations with securities.

Directors from securities involved in securities operations should include seven representatives of firms that serve wide circles of investors, three specialists and one broker from the Exchange Room. Another director must submit a firm that does not have branches throughout the country, a "specialized" company, for example, which is engaged in arbitration, or a small highly specialized brokerage company conductive research. In addition, half of these directors present public firms and must be associated with firms outside New York.

The NYSE also includes several international advisory committees. Their task is the development of the stock exchange, the development of its policies and management methods.

Members of Exchange

Since 1975, the New York Stock Exchange has become a non-commercial corporation belonging to its 1336 individual members. The members of the members can be sold, the cost of one place comes to $ 3 million, as well as lease to those who meet the requirements of the Exchange. Approximately the third part of all places on the exchange is rented.

Depending on the type of trading activity, NYSE members are divided into four categories: specialists; Commission brokers; brokers in the hallway; Broker. Of the 1366 members of the stock exchange approximately 700 people are commissions brokers, 400 - specialists, 225 - brokers working in the hall, and 41 are registered traders. Such specialization is due to both the operations produced by certain members of the Exchange and the types of operations.

Experts work on trade places. Their main function is the direct conclusion of contracts. Income is obtained at the expense of the Commission (if they act as brokers), or in the form of a spread (if they act as dealers).

Commission brokers conclude transactions in the trading room and serve brokerage firms, fulfilling orders of their clients.

Brokers in the Exchange Hall helps other membership members to execute orders without the right to work directly with external clients.

Registered traders trade in securities at their own expense are exempt from paying commissions.

Only individuals can be members of the Exchange, but if a member of the Exchange is a co-owner of the company, the whole firm is also considered a member of the Exchange. The dominant firms that are members of the New York Stock Exchange include several dozen investment banks, they have become key in the US stock market.

To become a member of the Exchange, you need to buy a place for its current owner. At the same time, a person who claims to membership in the Exchange must pass a written exam, have the recommendations of the two actual memberships of the Exchange and to obtain the consent of the Exchange. In addition, according to the Charter of the Exchange, its member must correspond to the age of "the age of the majority necessary for the responsibility of contracts in the field of any business that he is engaged." Members pay introductory and annual contributions to maintain their status.

Birzhi activities

In 2014, the New York Stock Exchange ranks first in the ranking of capitalization stock exchanges. About 60% (more than 300 billion) shares of the whole world are quoted on this trading platform. In 2013, more than 3,500 companies presented their shares on it, and their total capitalization amounted to 17 trillion US dollars. At NYSE, it is prestigious to put out its shares to companies even with the biggest capitalization. Bidding takes place on the stock exchange not only on shares, but also by other securities. Being a member of the Exchange is a real privilege.

The New York Stock Exchange solves the following tasks:

- Prepares premises for relevant business operations;

- provides working conditions to members, artists and organizations to members of the Exchange;

- develops and implements fair trade principles;

- performs the functions of the Chamber of Commerce;

- performs the functions of the exchange;

- Supports a high level of commercial honor among members and member organizations.

In general, NYSE is a market tool for accumulating temporarily free cash.

The New York Stock Exchange constantly cooperates with various regulators and organizations, including CFTC (Commission on Commercial Futures) and Securities Commission.

Listing NYSE.

Listing is the inclusion of the company's shares in quotation sheets. Listing on NYSE gives companies access to significant financial sources. In fact, every major American company passed there. Listing.

Listing on the New York Stock Exchange has passed more than 3,500 companies, of which about 450 are foreign out of 53 countries. Companies, past listing include, both more reliable, stable companies, so-called "blue chips" and young, rapidly developing. New companies fall into quotation sheets after the public placement of their shares on the stock exchange. To pass the listing, the company must comply with the rigid financial and legal requirements of the Exchange. Companies that have been listed must pay membership fees. Currently, the NYSE quotation sheet is replenished largely due to the inclusion in the listing of shares of foreign companies.

On the New York Stock Exchange to pass the listing, it is necessary to have indicators not lower:

Income before paying taxes over the past year - $ 2.7 million.

Profit for 2 previous years - 3.0 million dollars.

The net value of material assets - 18.0 million dollars.

The number of shares in public possession is $ 1.1 million.

Course value of shares - 19.0 million dollars.

The minimum number of shareholders owning 100 shares and more is at least 2 thousand.

The average monthly trade in shares of this Issuer should be at least 100 thousand dollars over the past 6 months.

To register your shares on NYSE, the company must send a request for the stock exchange. If he is accepted, the company sends a formal request to which a positive answer is given.

Trade in the New York Stock Exchange

NYSE is open to trade from Monday to Friday from 9:30 am to 4:00 pm Eastern time, with the exception of holidays announced by the stock exchange in advance.

Exchange trading is carried out in the operating room, the dimensions of which are approximately equal to the football field. Now the stock exchange room is divided into 18 trading zones, and in the perimeter there is an instrument of telegraph telegraph communications, according to which information on the purchase and sale of shares from brokerage firms into the operating room and back is transmitted. In each trading area, operations are underway with certain types of shares. Bonds and less popular shares traded in an extension.

The process of trade in securities on the NYSE occurs in the form of auction, while, for each promotion in the trading room, a certain place is assigned. The trading room is a "hellish" place, however, despite all the difficulties on the stock exchange, the order is maintained, and all trading are studied periodically for the identification of significant violations.

Trading on the New York Stock Exchange is a big anthill - participants here practically stand in queues to put their applications. Experts of the Exchange are executed by orders of buyers and sellers, determining the price for a traded asset in the market in accordance with the laws of supply and demand. They are from time to time (approximately 10% of time) contribute to trading, using their own capital, and distribute information that helps bring new buyers and sellers.

Individuals can perform operations on the stock exchange through broker house brokers. These brokers act as "financial consultants" and to carry out their activities, they must have a license, pass the qualifying exam and be registered on the NYSE and in the Securities and Exchange Commission.

Investor's applications are sent from the head office of the brokerage home Brokers of the Hall through complex electronic communications and processing systems.

Specialists collect all applications of brokers for the purchase and sale of certain shares. Each share is serviced by a specialist who acts as auctioner and is in a certain place in the operating room of the stock exchange, which is called a shopping post. All brokers - buyers and sellers for each promotion are collected around the relevant shopping post. Brokers loudly shout their applications - Competition of applications determines the price.

From January 24, 2007, trade in all the shares on NYSE could be carried out on the electronic hybrid market (with the exception of a small group of very expensive assets). Now customers could send orders for immediate electronic execution, or send orders to the trading platform for trade in the auction market. In the first three months of 2007, over 82% of the total volume of orders were directed in electronic form.

The New York Stock Exchange, having the most modern computers with which you can carry out transactions with millions of shares per day, could well develop a 24-hour trade system. But some brokerage companies exchange are not in a hurry with the preparation of their own system. The administration is leaning towards the transition to round-the-clock trade due to the fact that the exchanges of the whole world are engaged in the development of new trade technologies to ensure the interaction of buyers and sellers of various securities.

Revenues and expenses NYSE

The income and expenses of the New York Stock Exchange consist of:

- entry contributions of new members;

- membership fees;

- fees for transactions in the operating room;

- fees for services and equipment;

- other fees.

The New York Stock Exchange acts as the strongest news generator and is engaged in serious publishing activities, sponsors research and training projects. It is also a tourist center and landmark of both cities and countries, a kind of financial symbol of the United States. This interest is used by the New York Stock Exchange for more profit.

NYSE indices

The most famous are the following stock indices:

Dow Jones Industrial Average, which is calculated at prices of 30 companies "Blue Chips";

Standard & Poor "S 500, which reflects the shares of the 500 largest companies;

NYSE COMPOSITE INDEX, which includes all ordinary shares traded on the stock exchange, is the main indicator reflecting the market situation. It is also complemented by various indices of individual industries.

NYSE security system

The identification of unfair market participants is one of the objectives of the exchange as a self-regulating organization. Nobody is so hard and thoroughly regulates itself as the stock market. Strict standards and requirements for professional bidders, an extensive system of regulatory services - all these measures to control the activities of participants.

The supervision service for the New York Stock Exchange market is engaged in the investigation of unusual trading situations - trade cases using insider information, violation of the rules of trading, reporting rules, etc.

Buying a large number of shares before the share price has greatly increased, immediately fixed the system of observation of the bidding. Investigation on the subject of communication of people who participated in the transaction, with the company, whose shares were purchased, or with people related to this company.

The advantages and disadvantages of the New York Stock Exchange.

Today, the New York Stock Exchange NYSE is considered the main world trading platform. Not only for America, but for the whole world of finance, it is the greatest and large stock exchange.

In the history of its creation, it is important to be important to 1792, when 24 brokers from New York signed an agreement on the creation of a new stock exchange. It was done in order to be able to maximize its commission deductions.

Next, NYSE introduces the listing of shares and begins to exchange them on an ongoing basis. In order for the shares to approach NYS & EB, the companies were forced to be coordinated with the capitalization parameters - there was such a new condition on the trading platform.

NYSE received its full name in 1863 - New York Stock Exchange. The American Stock Exchange is currently developing towards being able to absorb as many other trading platforms as possible. Merge for NYSE - an important factor!

Trade on the NYSE Exchange

Trading on the NYSE Exchange is a big anthill - participants here practically stand in queues to put their applications. Companies registered in the New York Stock Exchange are world market leaders - these are the largest and solid firms from America, but also from around the world.

All shares are supported by specialists - this is the main feature of the NYSE trade. Shopping on the stock exchange is performed thanks to a specialist and a hall broker. There are works on brokerage homes and independent NYSE brokers. The sale of NYSE shares is in such a way that its preliminary analysis is initially made, so that the person understands that in the future it is necessary to do with such an action.

Trade Trade on the NYSE Stock Exchange

Trading on NYSE occurs in such a way that the trader increases not only its profits, but also the company's revenues. The main principle on which the work of the NYSE platform is based on the trader, as well as to accompany it all trading operations. Most often quotes NYSE resistance / support levels unfold absolutely not in the direction that is needed, but in the opposite.

World or national events, not even depending on the economy, can affect stock prices. The most common way to trade on NYSE is considered to invest securities. Profit or risk to suffer losses are distributed between all clients. Only so you can instantly get a lot of securities, not spending on it large sums.

Trade on NYSE: pros and cons

The famous global exchange is constantly under the close attention of not only famous traders or newcomers, but also a special commission. That is why NYSE Exchange has both pros and cons. Consider them more threatening.

Advantages of the New York Stock Exchange.

The New York Exchange is considered the largest capitalization, because the volume of shares that is on it is more than 60%.

Liquidity - sale, purchase or decrease - any order is performed in less than a second.

A large number of tools during trading.

Daily update of corporate news.

Of the flaws of the exchange leader, you can select the following:

Considerable commissions that make a challenge for profit.

Complexity with translation / output of money, opening your own account.

Large Gaps, due to the complexity of trading and transfer of positions through the night.

Instant blasting uncontrollable movements, NYSE forecasts are changed every second.

SDG-TRADE provides trading services in the US stock markets. We recommend passing training, explore the trading platform on the demo account and only after that transfer to the opening of a real trading account.

What is an abbreviation from NEW YORK STOCK Exchange - The largest American Stock Exchange in the world, located in New York. Being a symbol of the economic power of the United States and the place of completion of 60% of all stock transactions of the planet, NYSE is the "birthplace" of all attacks and falls of the last hundred years.

From who captures the initiative on NYSE (bulls or bears) depends on the global trend on the decline or growth of the economy. The work of the trader can not even be submitted without monitoring this site, since the decisions of New York after 10-12 hours (due to the difference in time) are reflected in European and Asian quotes. Many are repelled in their activities from her.

This exchange symbolizes the power of the US financial system.

At the moment, it is the largest in the world, and its total capitalization is within 28 trillion US dollars. According to the latest data, the NYSE Exchange Trading 4000 companies, half of which are American. The organization belongs to InterContinentalexchange and is regulated by the Securities and Exchange Commission.

NYSE work time

The discovery and closure of trading occurs at the beginning and at the end of each trading day. The very work of the New York Exchange takes place from Monday to Friday, from 9:30 to 16:00 East time. Today, trading is almost fully automated. The exception is only very rare and expensive shares.

NYSE today is the main hybrid market.

For non-residents of the United States, the time of work of the New York Stock Exchange does not play such a strong role as before, because the bidding are performed less percentage of seconds and passes this in the format of a continuous auction.

Currently, to start trading on the NYSE Stock Exchange, investors need to find only a brokerage company that is certified for trade with NYSE.. After that, they receive online access to the stock exchange with the help of special software and can freely buy and sell shares of the New York Stock Exchange, acting both independently and following the Soviets of the Broker.

Short story

May 17, 1792, 24 brokers who traded both the British in the coffee shops signed Boottonvian agreement (so Buttonwood Agreement is translated - under the tree Platan) On the creation of the New York Stock Exchange. The Bank Of New York (The Bank of New York) became the most first securious paper on the stock exchange.

The next 25 years, trade on the stock exchange was declarative and, largely, barter character. In parallel, the exchange in Philadelphia was developed until the race from New York went there with a friendly visit - it was in 1817. Upon returning, two decisions were taken: on admission to the auctioneer trades (in fact, speculators) and transferred trade in securities from the coffee house on the stock exchange. And then - the irony of fate.

The fact is that in 1840 the German inventor Samuel Morse Parent the telegraph, and it happened in New York. An interesting and useful invention was noticed on Wall Street, and the New York Stock Exchange introduced it in its activities, technically ahead of Philadelphia. The number of players rapidly grew, in 1869 a decision was made to limit traders.

Very, by the way, the broad introduction of the telegraph, which happened at this time. Achievements in wired bond allowed to buy and sell assets through a telegraph, raising trade to a qualitatively new level and making the process itself very flexible and dynamic.

The Exchange actively continued its height until the very beginning of the civil war, and trade in securities, goods and gold reached unprecedented scale.

Not everyone knows that Wall Street was not always the financial heart of America. several times changed their location before it is finally settled in your current place in 1865..

The exchange building is a bright sample of neoclassicism, so in 1978 it was even registered as a historical object.

In 1867. The first ticker of securities was introduced.

In 1878. Exchange received a weighty impetus to development. It is associated with installing telephones that give investors direct access to brokers on the stock exchange. NYSE activity has increased dramatically, and its members exceeded 1000.

in 1896. I saw the light of the stock index, in 1907 the world's first economic crisis occurred. In 1934, the platform is registered as a national stock exchange, in 1965 leads his index Nyse Composite Index (NYA).

Mergers and reorganization

In 1971, the National Association of Securities Dealers NASDAQ. (NASD.) I founded my own stock exchange that specialized in e-commerce and ultimately became an opponent NYSE in the United States. The presence of such a competitor forced the stock exchange to actively develop.

In 2006, NYSE was united with Archipelago Holdings ( ArcaEx.), forming NYSE GROUP, INC. A few months later, the NYSE Arca Electronic Exchange is created, and NYSE Group, Inc. United with NV, which manages stock exchanges in France, Belgium, Amsterdam and Portugal, formed the first intercontinental stock market.

After that, the merger, the NYSE EUROEXT traditional trading system was actually abolished in favor of e-commerce. Shares of United NYSE and EUROEXT traded under ticker NYX..

In 2011, NYSE EUROEXT filed a purchase request, however, this attempt was rejected by European regulatory authorities, since this would lead to the creation of an absolute monopolist. In 2011, for the same reason, the purchase was banned NYSE INTERCONTINENTAL EXCHANGE, AMERICAN FUTURES Exchange and Nasdaq Omx Group. In December 2012, Nyse Euronext acquired InterContinentalexchange, after which NYSE separated from Euronext.

What is interesting, in 2016, Deutsche Borse is already undermining the purchase of the London Stock Exchange () for $ 30 billion, which makes it a strong rival for NYSE in Europe. However, despite new competition, NYSE still remains the largest stock exchange in the world and in terms of market capitalization exceeds not only its main competitor - NASDAQ, but also the London Stock Exchanges.

NYSE Exchange System

Today, many inhabitants (mainly thanks to Hollywood's products) have a little incorrect idea of \u200b\u200bthe work of the Exchange. The "canonical" image of NYSE in the film is a real bird market, where everything is painted, bright, noisy and incomprehensible. Today, falling on the stock exchange (for example, within the framework of the excursion), the visitor will see the situation that is not very different from some major office. Brokers imparting in front of their computers eaten, read the press, or shifts with colleagues about the fact. This is due to the fact that the main direction in which the modern New York Exchange is running - online. So the outer picture is very deceptive. While the broker is slowly absorbs his lunch in front of the monitor, huge amounts of money pass through his accounts.

Numerous "posts" (small kiosks) are scattered in the NYSE operating room, for each of which certain shares are fixed. At these posts, a specialist (read "Auctioner") holds a bilateral auction between buyers and

sellers, forming the market for their shares. Each share issuer represents only one specialist (for example, only one person is engaged in GE shares). However, each specialist can engage in many different shares.

The trading hall of the Exchange itself is characterized by good ordering, in particular, conducting checks of transparency of trading. Additional means for monitoring are video surveillance and use of audio driving devices.

Interesting thing. Since 1903, the bell is ringing the bell, replaced by a hammer knock. Despite the fact that in fact, the bidding stops the computer system, the bell always breaks. Honor to hit him awarded athletes - Joe Majio and Michael Phelps, musicians - Snoop Dogg and groupKiss, politicians - Rudolfo Juliani, Nelson Mandela, Kofi Annan and Ban Ki-moon. Also on the list of lucky servicemen, rescuers, valiant doctors and fabulous heroes - Darth Vader, Mickey Mouse and pink panther.

This exchange is the largest on the planet from the point of view of market capitalization. No wonder it is also called a big scoreboard. Daily CNBS and other major business channels broadcast the Bourgeing Hall of the NYSE. It is located at Wall Street, 11.

Work is carried out daily from Monday to Friday from 17:30 to 00:00 hours on Moscow time or from 9:30 to 16:00 by NY.

The main difference between the New York Stock Exchange from other similar sites is a huge trading toolkit, namely more than 8 thousand shares at the disposal of brokers.

The main condition for NYSE is absolute transparency. Everyone see everyone. That is, at any time, using special applications that are designed specifically for NYSE users (Level-2, Arca Book, NYSE Open Book), you can track the actions of traders, thereby making the overall picture of the market.

A high degree of control set over NYSE guarantees security. Not only is the activities of the Exchange are under the strict control of financial organizations with the relevant authority (US Congress, Securities and Exchange Commission), also ensures compulsory insurance of accounts, open

traders. It is impossible not to note the high level of informatization and mobility of the exchange. In particular, high-speed trading terminals allow you to execute transactions for record-lasting time in the share of milliseconds, which for any trader can be decisive in matters of obtaining a positive transaction result.Trading and controls

In response to the collapse of the market in October 1987, NYSE installed the system of the circuit breaker, which was launched in October 1988. The essence of her work is to temporarily stop bidding, with a sharp price drop in a short period of time. The system was developed in accordance with the recommendation of the federal report of the Breidie Commission, which said that rapidly falling prices could enhance panic among investors and lead to avalanche-like market collapse.

Another stimulus for the introduction of this system was the desire to influence broad price fluctuations. The latter can create uncertainty regarding the execution of the order, which encourages investors to refrain from trade until the situation stabilizes. NYSE declares that a small pause has a positive effect on trade, as investors receive time to assimilate incoming information and commit the most suspended and conscious choice during periods of high market volatility.

Picture "Floor of the NYSE" - Kamil Kubik, 2010

Initially, triggers for the suspension of trade were tied to the middle ( fall of about 10, 20 and 30% in 15 minutes). In 2013, the rules have been changed and installed new triggers of the circuit breaker (7, 13 and 20% in S & P 500). It was also decided to stop bidding for the remaining part of the trading session at all, if the market will decrease at once for the specified period of time by 20%.

Since the creation of the switch system, they have already stabilized the work of the exchange during periods of stress several times:

- October 1997.. Dow Jones fell immediately by 7.2%, in response to an outbreak of the Asian financial crisis.

- September 2001.. After the terrorist attacks in New York on September 11, NYSE was closed into four trading sessions. This is the third time in the entire history of the Exchange, when the exchange was closed more than one session.

- May 2010.. The Dow-Jones industrial index fell about 10%, which became the largest intraday percentage decline since 1987.

- October 2012.. A break was made for two days because of Hurricane Sandy.

- July 8, 2015. Trade was stopped because of a panic, which was broken after the receipt of information on a possible cyber attack on the stock exchange (there was no evidence of the security violation of the security subsequently).

It should be noted that the changes made on the NYSE were soon adapted and applied to others, and now some other exchanges around the world adopt similar systems of control.

Organization and licensing

Until 1868, the number of NYSE participants was fixed (total 533). This limitation proceeded from the fact that in the first years of the existence of the Exchange, the members of the club personally participated in the conclusion of transactions, occupying places in the trading room.  NYSE participants had the opportunity to directly trade with stocks on the stock exchange. Because of this privilege of the place, which were originally sold at a price of $ 25, over time, became valuable and became the goods themselves.

NYSE participants had the opportunity to directly trade with stocks on the stock exchange. Because of this privilege of the place, which were originally sold at a price of $ 25, over time, became valuable and became the goods themselves.

For example, in 1928, the place on the stock exchange was sold for $ 625,000 (which is equivalent to about $ 6 million in our day). In 1878, the number of seats was established at a fixed level of 1060, although in 1953 it was increased to 1,366.

Everything has changed in 2005, after reforming the NYSE ownership structure. Now Exchange sells not places, but annual trade licenses. Unlike places, the license cannot be fericed, but at the same time they can be transferred during the change of owner of the company.

Assets and shares on NYSE

Today NYSE has five regulated markets, including the stock exchange itself, as well as Arca, MKT and Amex Options and NYSE Bonds. They are created so that large, medium and small companies compete "in their weight category" and received the most favorable conditions for their status. Investors can trade in several asset classes, including shares, bonds and options.

NYSE indices

As for NYSE INDEX, today the stock exchange has several largest and influential stock market indices. The largest of them are:

- Dow Jones Industrial Average;

- S & P 500;

- NYSE Composite;

- NYSE US 100 Index.

Listing NYSE.

NYSE is currently the world's largest IPO provider. At the head of the list of the most successful companies there are so-called "blue chips". Here everyone can see such familiar names like Apple, General Electric, Twitter Inc., Pfizer, P & G and many others.

It should be noted that to pass the listing on the NYSE companies should have excellent indicators and correspond to a number of criteria.

The largest companies on the NYSE Exchange

- 3m Co.(NYSE: MMM) (industrial conglomerate)

- American Express Co. (NYSE: AXP) (credit services)

- AT & T. (NYSE: T) (Telecommunications)

- Boeing Co., The (NYSE: BA) (Aircraft and Defense)

- Caterpillar, Inc.(NYSE: Cat) (Agricultural and Construction Equipment)

- Cisco Systems. (NASDAQ: CSCO) (telecommunications)

- Chevron Corp.(NYSE: CVX) (Oil and Gas Company)

- Coca-Cola Co. (NYSE: KO) (Drinks)

- E.I. Du Pont De Nemours & Co. (NYSE: DD) (Chemistry)

- Exxon Mobil Corp. (NYSE: XOM) (Oil and Gas Company)

- GENERAL ELECTRIC CO. (NYSE: GE) (industrial conglomerate)

- THE GOLDMAN SACHS GROUP, INC. (NYSE: GS)

- Home Depot, Inc. (NYSE: HD) (Building Supplies)

- Intel Corp. (NASDAQ: INTC) (semiconductors)

- International Business Machines Corp. (NYSE: IBM) (computing)

- JPMorgan Chase and Co. (NYSE: JPM) (Financial Group)

- Johnson & Johnson Inc. (NYSE: jnj) (chemistry, pharmaceuticals)

- McDonald's Corp. (NYSE: MCD) (fast-food restaurants)

- Merck & Co., Inc. (NYSE: MRK) (Pharmaceutics)

- Microsoft Corp. (NASDAQ: MSFT) (Software)

- Nike Inc. (NYSE: NKE)

- Pfizer, Inc. (NYSE: PFE) (Pharmaceuticals)

- Procter & Gamble Co. (NYSE: PG) (household chemicals)

- Travelers. (NYSE: TRV) (insurance)

- Unitedhealth GROUP Inc. (NYSE: Unh) (Health)

- United Technologies Corp. (NYSE: UTX) (industrial conglomerate)

- Verizon Communications (NYSE: VZ) (Telecommunications)

- Visa, Inc. (NYSE: V)

- Wal-Mart Stores, Inc. (NYSE: WMT) (trading network)

- Walt Disney Co., The (NYSE: DIS) (Entertainment Industry)

NYSE, Wall Street, 11

Shares are traded on the stock exchange, mainly American companies. In addition to them, there are also shares of organizations of non-American origin, in particular, from 53 countries of the world. In general, there are more than 1000 most liquid stocks. The volume of trade on the day at NYSE often comes to $ 3 billion.

It is worth noting that companies whose shares are traded on this stock exchange, are solid enterprises, leaders in their fields. Listing pass shares "", as well as young companies that are rapidly developing. The passage of this stage is characterized by confirmation of compliance with the most stringent rules, as well as the payment of membership fees.

The situation with Delivery is possible - the Board of Directors of the Company, which has lost interest on the part of traders, can accept decision to leave the Stock Exchange. Shares are withdrawn from trading. The seizure of the shares is also possible according to the results of mergers and absorption operations. During trading, stops are possible, which are due to too fast movement of the share price. Bidgest is made to balancing the list of applications and reassuring the market.

Exit to NYSE through Russian brokers

Working with the American stock market for Russian traders is not a complexity or problem, since there are brokers that provide access to the New York Stock Exchange.

Regulated FSA.and in Russia CRFR. Recommended initial deposit $250-300 .

Belongs to a broker that works over 20 years. The platform itself is under the control of European regulators Cysec.and Mifid.. Here you will find a huge number of shares, stock indexes, ETF funds and not only.

The broker offers a huge base of assets, the Academy (training programs), constantly conducts webinars, provides analyst and has a very convenient trading platform to which a large number of indicators are connected. In the platform itself there is a block with the latest news and forecasts in Russian. Minimal deposit $200 .

Official site:

Influence of NYSE on the economy

NYSE is one of the first world stock exchanges, and its appearance significantly affected the American, but also on the world economy. This organization accumulates and redistributes huge financial wealth. Only in one hour of her work, the turnover comes in exceeding the budgets of many states. According to statistics (assessment calculated by the World Bank), the trading volume on NYSE in 2016 approached 20 trillions of US dollars, which is about 20% of the gross global product. So the state of the global financial market does not depends on the work of the New York Stock Exchange.

If you have found a mistake, please select the text fragment and click Ctrl + Enter..