The time of the American Forex session. Schedule of trading sessions in the Forex market (Forex)

The European trading session is a session, during which the most trading transactions of the Forex market is carried out. The reason for this is the intersection of the work of the London session with the work of the American and Asian sessions. In addition, London is the world's largest financial center, where a huge number of major investors are concentrated.

Trade sessions - their types and timetables

Knowing the schedule of work of trading sessions, i.e. Opening and closing time, you will be able to effectively use your capabilities, rationally allocate efforts and trading time. Trade sessions are segments of time when the work and active trade in banking institutions occurs.

As you know, the Forex currency exchange is functioning around the clock - the beginning of its work from 00:00 Moscow time of Monday and the end at 23:00 Friday. Exchange does not work only by software. Such functioning of the Forex market is possible due to the presence of several trading sessions, the periods of opening time and the closure of which depends on where their centers are geographically, i.e. In which time zones.

Today, the 4th main trading sessions in trading for Forex are distinguished:

- (Main Center Tokyo),

- (with the center in New York),

- (Center London)

- and (centered in Sydney).

In other words, working time on Forex is divided into these sessions, i.e. At the time of their functioning. And know the schedule and the features of their work is very important and useful, because Different currencies during the operation of different sessions behave not equally. Today you will learn about the European trading session and its features.

What is the European Trade Session?

So, when traders from Asian countries are already going to complete their working day, their colleagues from Europe, on the contrary, are just going to start a working day. Europe has several sufficiently large financial structures, but the main one, of course, London, from which for a minute does not take off their views all participants in the Forex market. It so happened that the capital of Great Britain was constantly the center of world trade, because she has a very successful strategic location. Here every minute makes transactions of thousands of businessmen. If we talk about the Forex market, then for the period of work of the trading session in London there are at least 30% of trading volumes.

Since the largest stock exchanges are located on the territory of Europe, as well as all sorts, and very large and finally financial institutions that take the most active participation in the conclusion of transactions, the time of activity of the European trading session is the most active period for Forex.

Opening time and periods of activity of the European trading session

The opening time of the European session is 7:00 (GMT) or Moscow time - 10:00. The main players of this trading session are French, German and London Exchange, whose participants are located in such major financial centers as Paris, Frankfurt, Zurich, Luxembourg and, of course, London. Moscow time, the work of the European trading session ends at 19:30.

During the action of the European session, the activity of activity is approximately 11: oo Moscow time, just to the trading at this time, the Exchange with the Center located in London is connected, where there are a huge number of offices of the world's largest financial groups.

During the opening of the London Exchange on the market there are greatest volatility, because For this period, it is necessary to carry out the greatest volumes of currency transactions. The reason for this is simple - at this time all European banks are actively working, as well as many divisions of banks throughout Asia and America.

Such activity can be observed up to - 13:00 While dealers and brokers spend their basic deals before the lunch break. After that, there is a slight decrease in activity, but in the evening she is again increasing. Due to the fact that in Europe there is a significant amount of funds, during the activity of the European session, can be quite large. During this period, active bidding occurs related to the currencies of European countries - Danish Crown, Swiss franc, euro, etc. When the Exchange in London opens, and the English pound is joined.

Since the European session intersects with the completion of Asian, then its participants fall out the ability to catch the trends started in Asia. Closer to the completion of the European session, the American and this is happening daily, so the Forex can be trading round days.

Trade sessions of the market are moving from one to another when the evening occurs in one part of the globe and the auction stops, then the morning comes morning and trade is just beginning.

Immediately note that the European trading session is not the best time of work for newbies, because The beginning of its functioning is associated with a strong currency movement and growth in the price of a European monetary unit, i.e. EUR.

We will not argue, this situation is the best for obtaining a high profit, but only experienced traders who can track the simultaneous fluctuation of many currency pairs can quickly predict the market trend will succeed.

What you need to know about the European trading session?

For the reason that the European trading session in time of work intersects with two more sessions, and the capital of Great Britain, where the center of this session is located, this is the world's largest financial center - the largest part of the transactions performed on the Forex accounts for this period.

A distinctive feature of the trading session in Europe is a powerful monetary movement and a rapid change of quotations. Since the trade volume, which investors and traders root in the capital of Great Britain, has a huge size, the European trading session is distinguished by high volatility, i.e. Price variability.

As a rule, most market trends are formed when the trading session starts in London itself and they can continue until the opening of the trading session in America.

Also, the europe trading session is famous for its uneven movements. Since in the capital of England there is a huge number of dealers who exhibit orders, then during the European session, the first movement is often false. Dealers attempt to determine the places where the feet will accumulate how far the price will go, otherwise they check the market potential, as well as support / resistance levels. This dynamics among traders are known as the "London Durilka".

But it happens that during this session the first movement is true, because Everyone is trying to join him and the formation of a new trend, which, as a rule, is maintained until the session of the session in America.

Also, experienced traders are not recommended during the European session not to take active actions in the interval from 14: oo until 16:00. Even when on the market and occur during this period any movements, they are directed to the drain of currencies, which leads to the loss of many traders. Market trends, as a rule, change their direction at the end of the work of the trading session, because Most traders before the completion of their activities on Forex, begin to fix their profits.

Trading during the functioning of the European trading session, simultaneously monitor the output of statistics throughout the Eurozone, and especially in England. Also follow the performances and comments of European political and economic figures. All this will help you to be more prepared for the fact that the trend can change its direction that accordingly minimizes your losses.

Regarding the choice of currency pairs, which is better trading during the activity of the European session, you can carry out transactions with any currencies.

In addition, it is these valet pairs that are subject to direct influence overlooking this news time. You can also try trafficking crossings with Japanese currency, i.e. GBP / JPY and EUR / JPY, as during the work of the European session, these couples have increased price volatility.

The Asian trading session is one of the periods that give the opportunity to get quite good profits. Here, the main thing is to know the active currency pairs and choose the right strategy, since your trading result directly depends on its choice.

Immediately, we turn your attention that trend strategies to "catch" profits in hundreds of points will not work here. But trading from channel borders and will allow you to receive a stable income.

What is the Asian trading session and what is its features?

Asian trading session - the time of its activity and features of working with it

The Asian trading session suggests trading at Tokyo market sites, Hong Kong, as well as Singapore. It happens for the reason when the time of working activity of the Asian session practically coincides with the trading in the Pacific session, they are combined and sometimes it is difficult to determine where the trader is traded, but it depends on the broker chosen by him.

Asian trading session in 3: oo in Moscow. Then the opening hours begin in Hong Kong and on the Singapore site. The time of operation of this session is completed at 12:00 in Moscow. It should be noted that the Asian trading session is quite an interesting time on the stock exchange, although it has a relatively calm trend.

Here, there are often sharp jumps of Japanese yen, which are caused by both the events within the country and the interventions of the Japanese Central Bank. And, as you know, the Japanese currency is included in the main top of the currencies, which are most traded on Forex.

So according to statistical data, the Japanese yen accounts for more than 16% of transactions held in the foreign exchange market. And if you take the total number of all transactions per day held on Forex, then in the time of activity of the Asian session, they are at least 21%.

The feature of the Asian session is that the working schedule of the currency market begins early in the morning on Monday in the morning in Tokyo, so it is at that time most speculators begins arising during a day off day. Just at this time, the market is trying to fill out empty spaces and those who use GAPs in their strategy can raise their depot well.

It is on Mondays, in the opening hours and further work of the Asian session, there is a sharp trend movement, to predict which you can analyze the events of the events that have occurred. As a rule, this time is the most successful not only for trading on gaps, but also for those traders whose strategy is built on.

Psychological aspects are also added to all these facts, because most speculators are trying to catch everything that missed during the weekend and begin to actively trade.

On the other days, the Asian trading session is less active, and the movement on it can only be observed after 8:00 in Moscow. It is in this time period that the main European financial centers begin to work.

Peak trade is observed in the period from 9:00 - 12: OO in Moscow. In this watch, traders have already performed a preliminary analysis of the course movement and actively open positions.

As mentioned above, trading in the session under consideration is not limited to Japan's shores. The huge number of financial transactions lies in the territory of other financial hot spots - Singapore, Hong Kong, Sydney. The main participants in the auction here are central banks and major export companies, since the economy of such countries, for example, as Japan and China - export-oriented. For this reason, a huge number of companies and corporations are engaged in selling and buying currency.

Couple volatility during the activity of the Asian session

Also, the disadvantages of this session include potentially low profits at low liquidity and the presence of high spreads in some brokers on the main couples of currencies.

Work time, in the Asian session. Advantages and disadvantages

Trade sessions: trade with world-class

Schedule Trade sessions for forex Moscow time

The work of the Forex market is carried out around the clock on a specific schedule within 5 days a week. Naturally it would be strange if there were no time zones in his trade. World trading is focused on Greenwich's time (the city in the UK, through which the zero meridian is held). In the abbreviation, this time looks like GMT. All other belts form their time by summing or subtracting the number of time zones that are distinguished from Greenwich. So, Greenwich and Moscow divide three time zones, and Moscow time looks like GMT + 3.

With time zones associated with the trading session for Forex. In the general case, the trading session is the time during which trade in a certain region is activated when financial institutions and the bulk of traders begin their work. For proper trade, the trader must know:

Types of trading sessions on forex;

Features and time of sessions;

The use of indicators of trading sessions.

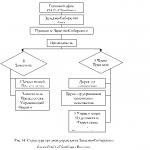

Types and timetable sessions on Forex

I have been leading this blog for more than 6 years. All this time, I regularly publish my investment reports. Now Public Investportfel is more than 1,000,000 rubles.

Especially for readers, I developed a course of a lazy investor, in which step-by-step showed how to establish order in personal finances and effectively invest its savings in dozens of assets. I recommend every reader to go, at least the first week of learning (this is free of charge).

The best way to fasten the theory is practice. In order to quickly understand the dependence of the behavior of financial markets when changing trading sessions, it is better to watch the schedules directly in the trading terminal. For this you can open, for example, a demo account at a broker, with which I have been working for more than 3 years.

Depending on the geographical location, the stock exchange differences four trading sessions:

Asian;

European;

American;

Pacific.

Trade sessions on Forex open asia session at 23:00 GMT and the beginning of the work of the Tokyo Exchange, and close at 22:00 GMT the end of the American trading session and the closure of the Exchange in Chicago. Of course, in each region, traders use their local time, for which the appropriate settings are provided in the trade terminals. Traders of the European part of Russia work mainly in Moscow. For practical use, it is convenient to reduce all temporary data in a table, including the schedule of trading sessions for Forex Moscow time.

Features of trading sessions

The differences between the sessions are not so much in time of work, but in trade features. The period of operation of each of the sessions is characterized by its most popular currency, its influence.

Features of the Asian session

Bidding on USD / JPY, EUR / USD, EUR / JPY, AUD / USD and other couples with yen and other Asian currencies are most active. Valve volatility is not very large and market, mainly calm. But attention should be paid to the time of the implementation of currency interventions by the Central Bank of Japan or the publication of national economic information. At this time, the currency can make significant jumps. As a rule, such events may occur in the period 01-03 GMT.

Features of the European session

The beginning of the European trading session somewhat captures the end of the Asian. In addition to the main participants, traders of other European countries, including Russia, are gradually included in the trade process. The opening of the European session, as a rule, goes quietly. The main movement begins with the opening of the London Exchange. Often, the opening of the session is accompanied by the exit of European economic news that give the currency to additional dynamics. The volatility of the main currency pairs is raised sharply, most instruments are trading. EUR / USD, GBR / CHF, USD / CHF, GBR / JPY pairs can bring the greatest profit. Of particular relevance, in addition to the euro, the British pound, Swiss franc and the US dollar become acquired. High volatility exists within 2-3 hours and in the lender period decreases. During the European session, the trends are characterized by a large amount associated with the significance of currency in the global economy.

Features of the American session

The currency movement begins to be activated with the beginning of the American trading session. At this time, banks begin to work, and European financiers return from Lunch. The fluctuations in courses during the American session do not exceed oscillations in the European session. However, the opening of the New York Bank may contribute to their adjustments to currency. And the most significant changes can be expected after the end of the European trading session, when American banks remain alone - during this period there may be even a fundamental change in the direction of the course. Mass yields of national economic news make the currency make multidirectional and chaotic movements. Currencies are noticeable and in the last days of the week. The most relevant tools with the US dollar, but are well traded and GBR / CHF, GBR / JPY. Market calm occurs approximately 21:00 MSK, with the end of the exchange.

Features of the Pacific Session

The Pacific session is considered the most calm trading period for Forex. The lack of large players leads to the fact that the market for hours can be in the FLET. The most liquid assets are Australian and New Zealand dollars.

The traders build their work, mainly by regional sign. However, many Europeans traded in the Asian session - most likely they are more suitable for a calm trading or strategy provides for trade in certain currencies at a certain time.

The choice of time for trading should be carried out with the own qualities and characteristics of the applied trading system. And it is not necessary to be time in the region of residence.

Significantly complicates the input of time. Trading strategies, settings of trading robots operate, as a rule, the GMT time and the trader have to recalculate this time to the regional. To simplify this process, many indicators of trading sessions have been developed, allowing traders to navigate the periods of sessions when developing and testing trade strategies and trade in trade.

Thus, the Forex Market Hours algorithm shows the session hours, noting active in relation to regional time. It can recalculate the time of translation of time on summer or winter. All these actions are made automatically.

The well-known indicator of I-Sessions trading sessions won great popularity. To work properly, it is only required to manually configure the start and end time of trading sessions and the terminal time correspondence.

With this indicator, the nature of the market is very visually visible in certain periods of specific sessions.

Time 2 VBO indicators are widely used - a convenient algorithm for short-term trade, simple and clear Aliev TM Trading and many others.

Indicators of trading sessions do not carry any trade load, but their informational support can provide the trader invaluable assistance in organizing their trade.

Conclusion

Many experienced Forex traders use knowledge of trading sessions. After all, many market participants, including large, are activated precisely within certain periods that can be used in their trade strategy. In addition, this knowledge will help to avoid many troubles associated with excessive currency activity tied to certain regional events.

And last. A clear next to the market time will allow the trader not to focus on one trade, but to properly plan their time, combining trade with a full-fledged holiday.

All successful trade and profit!

The time of operation of the forex currency exchange, as you know - the clock day, with a break for the weekends, i.e. on Saturdays and Sundays. We also note that in individual states, trading sessions may not even be held.

To date, four main trading sessions are allocated:

- American (New York and Chicago),

Today we want to figure out what is an American trading session.

What is the American trading session? Session time and recommended currency pairs

In the Forex market, the American trading session is essentially a session of the two, located in New York and Chicago, the dollar on which, this is the main currency, and the US coming to the USA influence the dynamics of almost all couples currencies. The economic situation in the USA has a very high influence directly on the process of trading in this session, and with a direct response to them of all bidders and very sharp jumps of exchange rates.

An equally important aspect is the time of opening a trading session in America - 16:00 (MSK) in New York and 17:00 (MSK) in Chicago. The operation time of this trading session lasts until 01:00 (MSK).

During the American session, in addition to the dollar, the European currency is very actively traded, because At this time, dealers from Europe are returned from the lunch break. Among other things, their colleagues from the United States, major banking institutions, American are very aggressive, as well as other interested in the speculative process on the stock exchange of the company and the company, are connected to the case. During this period, as a rule, quite important American statistical data come out.

In addition, pay attention to the time when the trading session is closed in Europe (19:00 (MSK)). During this period, American traders still continue to work on stock exchanges, as a rule, remain alone.

Often these players use the "thin" market and during the absence of liquidity capable of significantly promote currency in their own interests. Immediately, we note that the forces of both American and European banking institutions are approximately at the same level, for this reason in the market, when the sessions work (if you compare the American and European sessions) of strong changes are not observed. But at the same time, as we noted above, the closure of the European session, and especially before weekend, can increase greatly.

The American trading session is the hottest time in the Forex market. Right from the beginning of the session, there is an active saturation of the market liquidity and trade fairly large volumes. The reason for this is quite simple - there is a laying on each other of the European and American sessions.

In addition, there is an intersection of publications of important news and reports:

- in Europe in the afternoon,

- and in the USA - in the morning.

During this period, there are significant reversals and fluctuations in the main currency pairs in the Forex market, because The American trading session from others is characterized by increased aggressiveness and unpredictability, Therefore, experienced traders are recommended to take care of compliance with the basic rule of risk management.

For example, those trends that began during the session in Europe may be completely, and sharply, change when large merchants from America will enter the game.

The main currencies at the US session are:

- and CHF.

But the main currency pairs for the implementation of transactions:

- EUR / CHF, EUR / JPY,

- then EUR / USD, GBP / USD,

- And no less important USD / JPY, GBP / JPY.

Since the US currency is one of the most unparalleled, as part of the American session, will be worried during its significant fluctuations.

Although the American trading session with European over time intersects only two hours, but this period of work time on Forex is the most active. This period of time is so dynamic that it is often able to change the trend in an absolutely opposite side, which was determined in the morning.

Which session is it better to trade? We understand together.

What basic features should be taken into account in trade in the American trading session?

Next, we will tell about what major features prevail in the American trading session. So, the American trading session is divided into the Forex market into two parts. The first of them has dependence on fundamental factors, and the second allows transactions by means.

During the onset of the American session, there is a higher liquidity, because There is a lining (in time of work) of the trading session in Europe. Also note that most of the important news concerning the US economy is published precisely at the beginning of trade on the New York Stock Exchange, and since USD is one of the main exchange currencies, these publications significantly influence and affect the dynamics of almost all pairs of currencies.

For the reason that the US currency unit at this time appears in the market in a huge number of transactions, most of its participants will be forced to pay attention to the United States Economic Data released. In cases where these data are either better or worse than expected, they are able to sharply shake the market and arrange real "American slides" for the dollar.

Also to the features of the American session It can be attributed to the fact that the revival on it lasts approximately 18:00, after which some decline can be observed. At the same time, there may be sharp coursework fluctuations arising under the action of large players from the United States, which often lead the team game. Particularly large bursts are observed from 4:00 to 6:00 afternoon, when the market includes London and New York trading platforms. During this period, most traders are trying to squeeze the maximum from the market, and then close their positions without transferring them to the next trading day.

What trade methods are better to apply in the US session?

The period of action of the American session is considered the best - in a matter of minutes, some traders have time to take a fairly profit. Today, scalping is one of the most common types of strategies, especially in the beginners of traderism, so he gained popularity in the American trading session.

It is believed that during the American session, there are more sharp jumps in currency courses than in Asian or European. This is especially manifested by 23:00 (MSK) when the clock is shown in New York 15:00. By this time, the market participants becomes much smaller and price and trading activity is reduced - large traders from Europe have already completed their working day, as a rule, only US banks remain, which allows them to change the exchange rate to any of the parties by spending Much smaller amounts.

Before weekend (on Friday) activity on the American trading session is reduced, because Japanese traders are absent, and European (in the prevailing quantity) is trying early to go to the weekend. In addition, most American exchange players try on Friday before weekends to record the existing profits already, so the main trends can be observed a significant rollback.

The United States was, and at this stage remain one of the most liquid from the markets. Cash rapids committed during the work of the trading session in America are simply striking in their magnitude. For Forex at this time, they prefer to trade those who love, and have the desire to take part in the section of a taverged cake, in the period when at the same table, the largest number of hungry mouths were collected. Trade in the market is very specific, because During the American session, you can observe the most powerful price movements.

What do you need to know during the trade period of the American trading session?

What kind of currencies are better to trade when the trading session is open in America? During the period of simultaneous work and session in Europe and the American session, it is possible to use all pairs to trade for trading, since at the forex during this period the largest liquidity is observed. At the same time, experts recommend better attention to pay Major`am, as well as their cross, keeping distantly from the so-called exotic currencies.

When exactly trade in the American session?

If your trade takes place on day charts or on H4, then simply engage in the opening or closing of your positions by the end of the current daytime candle and do not pay special attention to trade sessions. If your trade is carried out inside the day (the period in the charts is 1 hour or lower), then it is better to conduct your activities during the beginning of the American session and in the next 2-3 hours of its work. Then the existing transactions are best close and start trading only the next day.

To avoid confusion in the opening and closing time of different trading sessions, because We all live in different temporary belts, and some countries also carry out the transition from summer time to winter, and then back, you can use the services of free services, for example: " Calendar of trading sessions».

It is represented in the form of a table where the colors are indicated by the duration of each of the session throughout the day, i.e. The beginning and end of her work. Here you can also use the indicator for trading sessions, for example, one of the most popular today is "i-sessions". On the MT4 terminal, this indicator is installed as any other. After that, adjust the start time, and closing the sessions already in accordance with the time of the work of your broker (in the "Market Overview" window to set hours).

The indicator on the chart will display the periods of each of the sessions with different colors, as well as in points to show how the distance passed the price during the session.

If you are conducting trading on the Forex Exchange, then the schedule of trading sessions follow the archive. Although such indicators are an additional tool, but in the work they are absolutely no extra.

It is really important! All about trading sessions

The Forex market has one distinguishing feature: it works 5 days a week, in the morning, afternoon, in the evening and night. Weekend on Forex fall on Saturday and Sunday. Such a mode of operation is associated with the fact that as soon as one continent is coming from the market (the clock region), work, or more correctly - the trading session begins on the other.

Distinguish 4. trade sessions Forex: Asian, European, American, Pacific. Each trader should be known about their features, since ignorance of certain properties of trading sessions leads to errors. These include untimely entry and exit from the market - each interval of a particular trading session may differ strong. Only skill and experience allow you to enter the market at such moments or get out of it. There are sessions and in the activity of trading, both in general and for some tools.

Schedule of trading sessions for Forex.

Schedule of trading sessions for a particular region depends on its location. Work begins in the foreign exchange market in the new days from the opening of the Asian session - it is 04:00 am nights in Moscow. An Asian trading session is ends at 13:00 Moscow time - this is taking into account the abolition of Moscow transition for winter time.

At 12:00, Europe is connected to the market - the European trading session begins, which officially ends at 21:00 in Moscow.

At 17:00 America starts work on Moscow time. The American trading session lasts until 02:00 am.

Finally, the Pacific trading session (Wellington, Sydney) connects to the auction at 02:00 on MSC and closes at 11:00.

Characteristics of Forex market sessions.

Asian trading session It is characterized by an active change in the price of currencies associated with Japanese yen (USD / JPY, EUR / JPY), Eurodollar (EUR / USD) and Australian dollar with US dollar (AUD / USD). Especially high the volatility of these couples with the approach of the end of the session, when the central bank of Japan is connected to the trading.

European trading session It is characterized by conducting active trading with the main currency pairs. At this time, the work of the largest financial centers of Europe is activated, one of which is London. The opening of the London market at 9:00 in Moscow entails an increase in market volatility, which partially decreases to dinner. By evening, the market is gaining momentum. In view of the fact that in Europe most of the money resources are concentrated, the change in currency courses is very tangible.

American trading session It is considered the most aggressive. With the opening of the stock exchange and banks in New York, the most active movement in the Forex market begins. The European session is still open, trade aggressiveness is not manifested, since the forces of American and European banks are balanced. But as soon as the European trading session closes, and America remains one "at the helm", a strong movement begins in the Forex market.

Pacific trading session is the most calm. At this time, strong currency fluctuations in the Forex market is not observed.

How to determine the beginning of trading sessions in a particular region?

Knowledge of the schedule of Forex trading sessions allows the trader to determine the most appropriate time, as he can lead the most profitable trading. After all, most strategies are applicable only to certain trading sessions - for example, a profitable Forex Strategy PROFX gives good results in the American and European sessions.

An excellent assistant in determining the time of schedule of trading sessions in one time or another time zone is. It is a table where different colors denotes the duration of the session during the day, in particular its beginning and ending. So, to determine when the sessions have to open in your region, you just need to open the page with the calendar. The script on this page will automatically determine your time zone and give all the information for your region. If you need to determine the beginning of trading sessions for another region - choose the desired UTC offset (GMT) and immediately get adjusted data.

Attention! If the time of your computer coincides with the time to the right in the column of the current time of the selected time zone: it means that the start and end time of trading sessions is defined correctly.

Table parameters change. Focusing on the top row with the clock and the color of the session lines, you can determine for what period of the day it is necessary. For example, in the figure below, the UTC time zone is selected +03: 00, which corresponds to the hour belt on which Moscow is located. The European trading session begins in Moscow at 11:00 local time and ends at 19:00. The American trading session lasts from 16:00 to 00:00, Pacific from 01:00 to 09:00, and the Asian session - from 3:00 am to 11:00 day. The current hour of the selected region is marked in red in the top row, the exact time is displayed to the right of the time zone selection window. If the time is correct, then the schedule of trading sessions for your region is defined correctly. If the time on the site does not match your local time, you need to select the appropriate time zone from the drop-down list. More details are the work of the calendar of trading sessions is considered on this page.

Screen calendar to determine the start time and end of trading sessions for different regions.