The value of the European Central Bank as the EU Institute. Central European Bank (ECB)

European Central Bank (ECB) — first in the history of Nadna-rational Central Bank, Began his active activity in 1999 with the transition of most of the EU states to a single currency of the euro. The European Foundation of the ECB was first the European Fund of Va Lovel Cooperation, and since 1993, the European Currency Institute.

European Central Bank (English. EUROPEAN CENTRAL BANK) - Central EU Bank and Euro Zone. Educated on June 1, 1998. Headquarters is located in the German city of Frankfurt am Main.

His staff includes representatives of all EU member states. The Bank is completely independent of the other EU bodies.

The main functions of the bank:

- development and implementation of the monetary policy of the euro zone;

- the content of official exchange reserves of the euro zone countries and the management of them;

- evrical banknotes issue;

- establishing major interest rates.

- maintain price stability in the eurozone, that is, providing the level of inflation not higher than 2%.

The European Central Bank is the "heir" of the European Monetary Institute (EMI), which played a leading role in preparing for the entry of the euro in 1999.

All key issues related to the activities of the European Central Bank, such as an accounting rate, accounting bills and others are resolved by the Directorate and the Board of Governors of the Bank.

The Board of Governors consists of members of the Directorate of the ECB and the Governing National Central Banks.Traditionally, four of the six places are occupied by representatives of four major central banks: France, Germany, Italy and Spain. Only members of the Board of Governors, who are present person or taking part in the teleconference, have the right to vote. Member of the Board of Governors may appoint a replacement if for a long time it does not have the opportunity to attend meetings.

For voting requires a presence of 2/3 members of the Council, However, an ECB emergency meeting can be collected, for which the minimum number of those present is not established. Decisions are made by a majority in the event of equality of votes, the voice of the chairman has a greater weight. The solution of issues related to capital, the distribution of profits is determined by the voting, the weight of the votes is proportional to the shares of national banks in the authorized capital of the ECB.

The ECB stands at the head of the European System of Central Banks (ESSB), which includes the ECB and all 27 central banks of the EU countries. The central banks of the states that are not part of the euro area are members of the ESSB with a special status: they are not entitled to influence solutions that are valid only for the euro zone.

ESSB is managed by three bodies - Governing Council Council, ECS Board (Executive Board) and General Council (General Council).

Council of Governors Includes members of the ECB Board (Executive Board of The ECB) and the Governorates of the Central Bank of the Euro Zone.

Board ECB He is elected for an eight-year term without the right to re-election, and its members are independent of those recommended and chosen their countries and governments. The right of the ESSB consists of president, vice-president and four other members.

General Council Unlike the Board of Governors, along with the President and Vice-President, includes managers of all prices of EU price banks.

Thus, the ESSB management structure is a two-tier taking into account the presence of two groups of countries. The School Council, like the Board of the ESSB, acts as a link between the countries of the Euro Zone (INS) countries and countries that have not included in it (Pre-Ins).

European Central Bank belongs a key role in the implementation of credit and monetary policy within the European Monetary System (EAR).

At the same time, its main task concludes in unification of requirementsFollowing financial instruments and institutions in the euro area, as well as in the methods of credit and monetary policy banks. In particular, before the creation of the EYU, the central banks of individual states have used various mechanisms of monetary regulation of the economy. So, not all EU countries applied the norms of mandatory reservation for commercial banks, and some of those who use them did not charge the interest remuneration. The mechanisms of refinancing credit institutions from the Storo Central Banks are distinguished.

European Central Bank uses the following the main tools of credit and monetary policy.

At first, It is envisaged to establish current target values \u200b\u200bfor major monetary aggregates to control the level of inflation.

Secondly, The ranges of oscillations of the main pro-valuable rates are determined, including to bring them closer over the entire euro area.

Thirdly, Minimal backup requirements are established for commercial banks, as well as in relation to the percentage of remittance. Now all ESU countries should apply the established unified reservation ratio and interest remuneration.

A single list of obligations is defined for which the standard is applied, as well as penalties for violating the reservation periods. The establishment of mini-reserve requirements as one of the goals is to align the levels of interest rates in the ESU countries.

Fourthly The combination of short-term liquidity regulation operations in the money market is determined, calling permanent mechanisms. They are divided into the whole on credit and deposit mechanisms of the ECB. Thus, the deposit mechanism includes the placement of temporarily free funds of credit institutions in the ECB deposits for a period of one day (Overnight deposits).

The rate established for these deposits forms the lower boundary of the one-day interbank loans for the euro market and is the minimum base rate in the ECB pro-spending rates. Similarly, the provision of one-day loans for credit mechanisms to the credit mechanisms. The corresponding interest rate determines the upper limit of the stock market of one-day interbank loans of the euro. However, one-day loans are provided with central banks for free.

The ECB gave the right to Central Banks EBU independent, but to choose the form of providing one-day loans, the main of which are mortgaged (lombard) loans and transactions of direct one-day repo.

As collateral over one-day loans can be used assets defined by the ECBand divided into two categories.Criteria that should meet both categories of both categories are also defined by the ECB. Upon receipt of refinancing loans in its National Central Bank, the Credit Institute once rebels the assets of one of the category in any depository on Terry Torii EBU.

The ECB established the size of the loans provided depending on the market value of the laid assets and the degree of its extent, as well as the standards for additional contributions or payments in the event of a change in the specified market value.

Fifth Operations are carried out on the open market, under the ESU imply any transactions in which the central banks themselves act as equal counterparties in the market, and not just operations in the securities market, as is common. Among these operations, the main and long-term refinancing instrument, as well as the so-called fine-tuning operations and structural operations are most important.

The main tool for re-financing It assumes the holding of weekly auctions for a period of 14 days among credit institutions at a fixed percentage rate.

Long-term refinancing tool Similar to the main, but provides for a monthly auction trading three-month loans. He replaced the existing EU in a number of countries before moving to euros the form of long-term refinancing through the exchange of bills.

The auctions on both instruments of refinancing is carried out decentralized, that is, the Euro-system central banks, but the total amounts of credit funds put on sales are determined by the ECB.

Operations of fine settings and structural operations are carried out irregularly and often in a short period when urgent intervention is necessary to regulate liquidity and interest rates in the ECU markets.

Today we will talk about what is European Central Bank (ECB): What is his structure, goals and functions, as he works, who leads them, what monetary policy is conducting, etc. Many interesting facts and useful information that is useful to all at least for general development, further in the article.

ECB: the history of creation.

The European Central Bank (ECB) is a central bank institution formed on 06/01/1998. EU member states, first of all, in connection with the introduction of a single European currency. The official document, on the basis of which the ECB was created, became the so-called. Amsterdam Agreement - Agreement on Amendments to the European Union Agreement, which was signed in October 1997 and entered into force in May 1999.

However, the first prerequisites for the creation of the ECB appeared much earlier. So, back in 1988. The signing of a memorandum "On the creation of the European Currency Space and the European Central Bank" was held, in 1992. A European Union was created, and in 1994. The European Currency Institute began to function, which was engaged in preparing for the introduction of a single euro. He became the progenitor of the European Central Bank.

The ECB is a central bank for the entire eurozone, and carries out its emission and control and regulatory functions there. The head office of this structure is located in Germany in Frankfurt. Official site ECB - ecb.europa.eu..

The European Central Bank is part of the European system of central banks, in addition to him, the central banks of all EU countries are included. That is, in each state included in the European Union, there is its central bank dealing with monetary policy in his country, but there is still an ECB that is responsible for the entire eurozone.

ECB functions.

Consider Key eCB functions.

- EURO EMISSION. This is the main function of the European Central Bank, for which, mostly, he was created. The euro is the official currency of the 19 countries included in the Eurozone, as well as 9 more countries - non-EU members, of which 7 are geographically located on the European continent. All decisions on euro emissions take exclusively the ECB, but the emission itself can also be carried out by the central banks of the countries of the euro zone.

- Maintain monetary policy in the Eurozone. The European Central Bank has at its disposal all key instruments for regulating financial markets: an accounting rate, reservation rate, operations with securities, etc. The entire monetary policy concerning the eurozone countries is within the competence of the ECB.

- Management of ZVL EU. In the European Central Bank, the EU is concentrated, and it makes decisions about their spending or replenishment.

- Maintain an acceptable inflation rate in the eurozone. This ECB function is also considered key. The European Central Bank is responsible for ensuring that the growth of consumer prices in the eurozone does not exceed 2%, but deflation would be allowed.

The structure of the ECB.

The European Central Bank is a joint-stock establishment existing on the basis of an international legal agreement. The shareholders of the ECB are state central banks of countries in the eurozone, and in different shares. The greatest lobes in the authorized capital of the ECB have:

- Deutsche Bundesbank - 18.9%;

- Bank of France - 14.2%;

- Bank of Italy - 12.5%;

- Bank of Spain - 8.3%.

The shares of other Central Bank EUROSPAN range from 0.1 to 3.9%. At the same time, the cumulative authorized capital of the ECB exceeds 5 billion euros.

The main body of the European Central Bank is the Council of Governors, which includes the heads of Central Banks of all Eurozone countries and the members of the Directorate (Executive Committee) of the ECB. It is the Governing Council that receives all decisions regarding the implementation of its basic functions and tasks.

At the same time, the ECB, like any joint-stock company, is the Board, which includes 6 participants: President (Chairman of the Board), Vice-President and 4 Member of the Board. Candidates for the Board presents the Board of Governors, after which they undergo a mandatory procedure for approval by the European Parliament and the heads of all countries in the eurozone. To date, the Chairman of the Board of the ECB is an Italian financier Mario Dragi..

The European Central Bank is legally an independent institution, independently host all the decisions that no one can imitate. However, it regularly reports to its activities immediately before four structures:

- European Parliament;

- European Commission;

- Council of the European Union;

- Council of Europe.

The activities of the ECB.

All activities of the European Central Bank are aimed at fulfilling their functions and the tasks that I considered above. For this, the ECB uses a variety of mechanisms and levers of monetary policy: provides long-term and short-term loans to the central banks of the EU countries, conducts mortgage auctions, participates in trading in the foreign exchange market, develops regulatory documents, etc.

The ECB accepts its key solutions at meetings of the Board and the Board of Governors, which pass according to the planned schedule in advance: about once a month or a little less often. For example, for 2016, 8 ECB meetings are scheduled.

Since the decisions of the ECB always have a very strong impact on the world, mostly - on the meetings of this banking institution, financiers and stock traders always follow. At the time of the announcement of the minutes of meetings and the speeches of the Head of the ECB, significant fluctuations in the foreign exchange market always occur, especially for the fact that many are used for speculative earnings.

It can be argued that the ECB decisions are largely determined by the further trend of the euro course in relation to the dollar and other global currencies.

In addition, the activities of the state and commercial banking structures of all countries belonging to the Eurozone: rates on loans and deposits, tariff policies depend on the decisions taken by the European Central Bank.

That is, ECB is a structure that regulates the credit and financial market of a large group of countries in order to ensure its stability and efficiency of functioning, as well as maintaining the optimal euro course and the level of inflation in the eurozone.

Since the European Central Bank is a joint-stock company, its activities are aimed at making a profit, which is used to further develop the structure and pay to its shareholders.

Now you have an idea what the European Central Bank is and what he is doing. You can also familiarize yourself with the article in which a similar body in the United States is described - - there are some differences in the general similarity.

Before new meetings, where you can always learn a lot of useful and important information from the world of economics and finance to increase your financial literacy. Do not forget to subscribe to our pages in social networks.

The main functions of the ECB:

- euro issue;

- adjustment of interest rates;

- management of the financial reserves of the Eurosystem;

- development and monetary policy control of the European Union;

- determination of the norms of mandatory reserves for financial institutions.

Eurosystem and ECB

The ECB began its work in 1998. Even before the introduction of the euro on the territory of the European Union, the European system of central banks was formed. It includes the ECB and Central Bank of all EU member countries.After entering the euro, part of the European Union countries decided to preserve their national currency. This was the cause of the Eurosystem, which united the central banks of the states overlooking the euro.

Guide ECB

The head of the ECB is the Chairman, this election position. The Chairman is elected for 8 years.Council of Governors and Board are the main bodies of the ECB. The Board of Governors includes members of the ECB Directorate, as well as the leaders of the Central Bank of all states of the eurozone. In order for the meeting of the Board of Governors to be eligible, it should take part in at least 2/3 of the total number of members, but in the event of an emergency organization, this rule is not mandatory. To make a decision, most votes need, with the equality of votes, the voice of the Chairman is decisive. When discussing issues related to the distribution of profits, the weight of the voice of the Council's member is equal to the share of capital in the ECB of the National Bank of the State that it represents.

The Board includes six people. Four candidates are nominated by the Board of Governors and undergo the procedure of coordination in the European Parliament. The two remaining vacancies are reserved for the Chairman of the ECB and his deputy.

ECONCHIAL POLISH ECB

The main difference between the ECB system from state banking systems is to implement monetary policies on a decentralized basis. The main financial organization of the European Union only makes decisions and determines the rules for their implementation - in practice, state central banks are performed in accordance with the current regulatory framework and instructions from the ECB.The activities of the ECB on the open market is refinancing and carrying out structural operations.

Daily deposits and ECB loans allow financial institutions to effectively manage liquidity when closing the interbank market. Thanks to them, various banking structures can make payments even with a lack of their own resources.

The integration and introduction processes of a single currency in Europe demanded the creation of a pan-European institutional structure capable of identifying and directing changes in the economic and political life of individual states.

The European System of Central Banks (ESSB) is an international banking system, consisting of a supranational European Central Bank (ECB) and national central banks (NCCs) of the European Economic Community Member States.

Fifteen National Central Banks, including: Bank of France, Bank of Italy, Bank of Spain, Netherlands Bank, National Bank of Belgium, Austrian National Bank, Bank of Greece, Bank of Portugal, Bank of Finland, Central Bank of Ireland, Luxembourg Bank, Bundesbank Germany, Central Bank Slovenia, Central Bank of Malta, Central Bank of Cyprus, as well as the European Central Bank ( ECB), Located in Frankfurt am Main, together form the European language and, according to paragraph 14.3 of the Charter of the ESSB, are an integrated part of the ESSB.

National Central Banks of States who are not members of the UEAV, Great Britain, Denmark, Greece and Sweden are members of the ESSB with a special status: they are not allowed to participate in decision-making relating to the Unified Monetary Policy for Eurozone and implement similar solutions.

In addition to common goals and objectives, ESSB elements are united and a rigid hierarchical structure of legal relations, which develops between the national Central Bank and the ECB.

The role of the National Central Bank inside the ESSB is reflected in Article 9.2, 12.1, 14.3 and 34 of the Statute (provisions) on the ECB and the ECB, in accordance with which they are obliged to act within the framework of regulations taken by the ECB.

The normative acts of the ECB are of great importance.

Basic guidelines (accepted by the Board of Governors),

Instructions (accepted exclusively Executive committee),

Internal decisions (taken by both these bodies) He heads the ECB European Central Bank with headquarters in Frankfurt am Main.

Objectives, tasks and general features of the ESSB organization are established in the European Union Treaty and in its Annex - the Protocol on the Charter of the ESSB and the ECB.

The main goal of the ESSB. - maintaining price stability, which is a prerequisite for providing prolonged economic growth.

In case of unconditional maintenance of stability, the ESSB should hold a general economic policy that meets the objectives of the European Community, who contributes to solving its tasks. In the Charter, the ECB also determined that "pursuing its goals, the ESSB acts in accordance with the principle of an open economy in the conditions of free competition."

The main tasks of the ESSB Listed in Article 105 of the Treaty on the European Union:

1. Definition and conducting a single monetary policy.

The ECB Governing Council defines a single monetary policy that the NCC is carried out decentralized. Basically, the procedures and tools for conducting monetary policy are those used by the majority of NCC to the formation of the currency union.

2. Implementation of currency transactions, and storage and management of official currency reserves of the participating countries.

The NCB transmits the ECB part of its reserves. The Council of the European Union and the ECB solve the problem of establishing a exchange rate between the monetary unit of the euro and the currencies of countries that are not included in the community.

3. Ensuring the effective functioning of payment and settlement systems.

In this area, it should be noted in particular, the implementation of the ECB of the payment and settlement system of Target, which allows the implementation of a single monetary policy. This system is mandatory for all calculations in which NCC or ECB play the role of a counterparty. The system ensures the intimidation of translations of large amounts of payments. It is based on national gross calculation systems in real time. The central banks of the European Union countries outside the euro zone allowed limited access to intraday liquid means of the system.

Among other tasks of the ESSB:

1. Emissions of banknotes and coins.

The ECB is the only organization that can resolve the emission of the banknote expressed in the euro. ESSB emits these banknotes. Euro coins are issued by participating countries after the approval of the volume of ECB emissions.

2. Cooperation in the field of banking supervision.

ESSB should contribute to the correct execution of operations by the competent authorities in the field of prudential supervision of credit institutions and the stability of the financial system.

3. Consultative functions.

The ECB advises the Council of the European Union or the authorities of the member countries, national central banks on monetary issues, payment and settlement systems, community legislation relating to the banking supervisory and stability of the financial system. The Central Bank may also make recommendations to the community institutions and national authorities in areas included in the framework of its competence.

4. Collection and accumulation of statistical data.

The European Central Bank fulfills the task trusted to him. For this ECB:

· Determines general mandatory regulations for all member countries. For example, the establishment of the procedure for calculating mandatory reserves and the definition of their total amount is the subject of one of the instructions of the ECB;

· Decides decisions in the field of its competence. For example, in July 1998, the ECB identified the conditions in which NCB and credit institutions outside the eurozone will be able to participate in the payment and settlement system Target;

· Imposes, if necessary, fines (up to 500.000 euros) or penalties (up to 10,000 euros per day) in case of non-compliance with the regulations and decisions. This, for example, occurs in case of non-fulfillment of economic agents of obligations under statistical declarations in the ECB or non-compliance with credit institutions of reserve requirements;

· Determines the order of relationship between the ECB and NCB inside the ESSB.

One of the basic principles of the operation of the ESSB is independence, defined in the contract. When fulfilling its powers and objectives, neither the ECB, none of the NCB or members of their governing bodies, cannot receive instructions on the community bodies, from the government of the participating countries or from any other organization.

The contract also includes other provisions seeking to ensure the independence of the ESSB and the ECB:

· There are enough long term of office for members of the governing bodies (for example, for members of the Board of Directors, this period is eight years, and the minimum stay in the position of managing NCB is five years);

· The term of office is terminated only in case of loss of working capacity or committing a serious mistake;

· All disputes and disagreements on the implementation of activities are within the competence of the European Court.

Independence is an important principle of ECB. However, the huge powers that this organization possesses are concerned with many specialists. In its strategy, the real needs of the Union countries are not taken into account. In particular, attention is not paid to the goal of the fight against unemployment, which constitute the core of the economic policy of the European Union. For this reason, the EU has a controversy around on the need to control the activities of the ECB so that it is responsible for its actions.

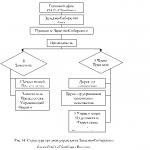

The structure of the ESSB Can be presented in the form of the following scheme:

The ECB is managed by the ECB authorized bodies - the Governing Council of the Governing Council, the Executive Board and the General Council (General Council).

Management Board, the Supreme Governing Body, unites members of the Board of Directors of the ECB and the chairmen of the NCB of the member countries of the Currency Union. This Council makes decisions necessary to fulfill the tasks trusted by the ESSB Treaty and its charter. First, it defines the monetary policy of the Union and establishes the directions necessary for its implementation. Thus, the Board of Governors fixes the basic interest rates taken within the foreign exchange union.

In addition, the Board of Governors approves the set of rules for the internal organization of the ECB and its governing bodies, performs the advisory functions of the ECB and determines the procedure for international cooperation.

To address issues to identify and conduct a unified monetary policy, the Governing Council votes on the principle of "one member - one voice". For decisions of the property order (for example, an increase in the capital of the ECB), the votes are weighed depending on the share of each NCB in the authorized capital of the ECB. If you need to decide a qualified majority of property issues, it is approved if no less than two thirds of the votes have been submitted.

Executive Committee (Board of Directors) includes president, his deputy and four members selected from the number of candidates who have great professional experience in financial or banking areas. Members of the Board of Directors of the ECB are appointed by mutual agreement with the heads of states or governments of the countries participating in the Currency Union, taking into account the recommendations of the Council of the European Union. Approval by the European Parliament is a prerequisite for appointing members of the Board of Directors offered by the Council.

The Chairman of the Board of Directors is the Chairman of the Board of Governors and the General Council. It has a decisive voice in case of equal voting distribution. In addition, the Chairman presents the ECB in external organizations. In the absence of the Chairman, his deputy chairs meetings of the Board of Governors, the Board of Directors of the ECB and the General Council.

Members of the Board of Directors must be citizens of the Currency Union member countries.

The Board of Directors is responsible daily for monetary policies in accordance with the decisions of the Governing Council. It was within this framework that the Board of Directors conveys the necessary instructions of the NCC.

The Departments of the ECB and the Board of Governors help 13 committees:

· Committee of Internal Auditors;

· Banknotes Committee;

· Budget Committee;

· Committee of External Communication;

· Accounting and cash income committee;

· Legal Committee;

· Committee on Market Operations;

· Committee on Monetary Policy;

· Committee of International Relations;

· Statistical committee;

· Bank supervision committee;

· Committee of Information Systems;

· Committee of payment and settlement systems.

General Council (General Council), the third governing body of the ESSB includes the Chairman and Deputy Chairman of the Board of Directors of the ECB and all chapters of the National Central Banks of the European Union (including those that are not included in the currency union).

The General Council helps the ECB when performing its advisory functions. Its main tasks include:

· Collection and processing of statistical information;

· Preparation of quarterly and annual reports on the activities of the ECB, as well as weekly consolidated financial reports;

· Development and adoption of the necessary rules for the standardization of accounting and reporting on operations conducted by the NCC;

· Taking measures related to the payment of the authorized capital of the ECB in a part not resolved by the General EU Combator;

· Development of job descriptions and rules for employment in the ECB.

· Preparation of countries to the transition to a single currency.

The Agreement provides for regular relations with all European Union organizations.

The terms of the dialogue between the ESSB and Council of European Union Provided in Article 109 of the Treaty. The Chairman of the Council of the European Union may be present without a decisive voice at the meetings of the Board of Governors of the ECB. Symmetrically, the Chairman of the ECB can be invited to the meetings of the Council of the European Union, when issues of the ECB are considered. In addition, the ECB sends his annual report to the Council of the European Union (as well as to the European Union, which includes the heads of state and governments).

Members European Commission Can participate without a decisive voice at the meetings of the Board of Governors of the ECB. In addition, the ECB annual report is sent to the European Commission.

The contract also provides that the annual report of the ECB on its activities and monetary policy of the previous and present year will be sent to European parliament . The possibility of hearing the chairman of the ECB or other members of the Board of Directors at the request of the Parliament or on their own initiative is envisaged. Thanks to the regular and in-depth Dialogue, the ECB introduces the European Parliament with its assessment of the economic situation and with the prospects for the movement of the price level and explains the policy they conducted.

Information on the relationship between the ESSB and other European institutions can be represented as a scheme:

In the ECB, the responsibility for the definition of a unified monetary policy is the Council of the Governors of the ECB. The ECB decisions are used in all countries of the currency union. All countries participating in the currency union conduct monetary policies in the same order.

Departments of the NCB, together with the Departments of the ECB and under the control of the Board of Directors, are involved in the preparation of monetary policy decisions. It is the NCB that is responsible for implementing decision-making policies adopted by the Board of the European Central Bank. The NCB is responsible for carrying out refinancing operations and provide evolution for national credit institutions. Credit institutions enjoy their accounts opened in NCB.

NCB explains monetary policy decisions and investigate the effects of the influence of a single monetary policy on the national economy.

It should be noted that the NCC of the countries participating in the European Union, which are not included in the currency union, received special status inside the ECB and conduct an independent monetary policy.

The European system of central banks provides storage and management of official gold and foreign exchange reserves of the UNEV member countries. The contribution of each National Central Bank is defined in accordance with its share in the capital of the European Central Bank.

According to the Charter of the ECB, central banks must convey to it (on a credit basis) currency reserves for a total amount equivalent to 50 billion euros (in the future, this amount by decision of the Board of Governors can be increased). The volume of reserves translated by eleven central banks of the EVA participants in its establishment to the European Central Bank amounted to 39.46 billion euros. Of these, 85% of the amount - in the currency, the remaining 15% is in gold.

Currency reserves that remain at the disposal of national banks are used by them to fulfill their obligations in relation to international organizations. Conducting other operations with these reserves, over the limit established by the Board of Governors, must be coordinated with the ECB. This is considered necessary to ensure coordinated monetary and monetary policy within the EVA.

Currency reserves can be used by the European Central Bank for currency interventions, and it is given the right to independently make decisions on providing such interventions. The European system of central banks is equipped with technical capabilities for interventions in foreign exchange markets in order to resist excessive or chaotic fluctuations in the euro's exchange rate regarding the currency of the main countries outside the UES.

ECB's own capital to the beginning of its activities is defined in the amount of 5 billion ECU. In the future, by decision of the Board of Governors, it may increase. ECB shareholders can only have national central banks. The capital of the ECB is formed in proportion to the Comparative Demographic and Economic Weight of the NCC. The key indicator at the same time is the average weighted proportion of each country in the population and GDP "Euro Zone", which is determined by the following formula:

50% of this fraction - in accordance with the specific weighing of each country in the total population of the European Economic Community;

50% - in accordance with its specific gravity in the aggregate gross domestic product of the UES.

These data are adjusted every 5 years.

Currently, the Euro zone includes 15 countries. In 2007, Slovenia introduced Slovenia's currency, and from January 1, 2008, Malta and Cyprus joined the Economic and Monetary Union. In September 2008, at the Conference of the Statistical Offices of the EU Member States in Vilnius, the EU Monetary Policy Commissioner Hoakin Almuni announced the political consequences of the financial crisis in Europe. It does not expect further expansion of the euro area, at least over the next two years. According to the European Commissioner, the collapse of financial markets and the global financial crisis will significantly affect all countries - EU member countries and will not allow for several years to discuss either the possibility of expanding the EU or eurozone.

With the introduction of the euro from January 1, 1999 and the transfer of fundamental authority from the National Central Banks to the European Central Bank, the leadership of the European Union and the ECB established official relations and began to actively develop cooperation with the IMF, BMR, OECD, leading industrialized countries as part of the Group 7, "Group 10" and others. The focus was the two main issues of interaction:

· Formation and consolidation of modern architecture of the global monetary and financial system;

· Promoting the expansion of the international role of the euro.

During 2000, two events occurred in relations between the European Central Bank and the IMF concerning the increase in the role of ECB in operations with special rights of borrowing - SDRS (Special Drawing Rights, SDRS). First, on November 15, 2000, the IMF approved the allocation of the ECB of the backup position, which provides the Bank the right to independently perform operations with the Emitted SDR Fund. The backup position allows the ECB to exchange SDRs at its disposal on convertible currencies that have the status of freely used currencies (US dollar, euro, English pound sterling and Japanese yen) in operations with IMF member countries and other SDR owners. Second, January 1, 2001, as part of regular (once every five years), the revisions of the cost baskets and interest rates of the IMF SDR decided to replace when evaluating the value of these baskets a country approach (Country-Based Approach) on a method based on the currency component ( Currency-Based Approach). From January 1, 2001, the proportion of the euro component in both baskets - the cost and interest rates of the SDR - is determined on the basis of economic indicators of the entire euro zone.

In February 1999, a Financial Stability Forum (FSA) was established in the Bonn of the Ministers of Finance and Heads of the Central Banks of the Group 7. Its main tasks are:

· Assessment of the degree of vulnerability of the global financial system;

· Development of specific measures in the field of oversight in order to eliminate vulnerable places of the global financial system;

· Improving coordination in the field of information exchange between the national authorities responsible for ensuring financial stability.

The FFS was initially included representatives of the ministries of finance, central banks, supervisory authorities of the Group 7 countries, as well as international organizations and working groups engaged in the development of financial and banking standards, supervision and monitoring of financial systems in order to ensure financial stability (BMR, IMF , World Bank, OECD).

Currently, the IMF in collaboration with other international organizations in order to reduce the vulnerability of individual countries to crisis is actively working on revising and strengthening supervisory practice, focusing on monetary, tax and currency policy. At the same time, in its supervisory practice, the IMF is increasingly consulting with the ESSB, in order to maximize the regional features of the development of foreign currency markets.

European Central Bank (ECB) - Central EU Bank and Euro Zone.

European Central Bank (Eng. European Central Bank) was created on July 01, 1998 in the framework of the Monetary Union. He is a successor created by the Maastricht Treaty in 1994

The Monetary Institute, whose task was to supervise the European currency system and the preparation of the currency union, for which it was envisaged in addition to developing convergence criteria to also create a central bank. The ECB is integrated into the European system of central banks, which also includes the central banks of all participating States, and in the Eurosista, which includes the central banks of the EU states who use the euro. In accordance with Art. The 13 ECB ECB treaties belongs to the EU institutions.

The Higher ECB Office is the EU Governor Council, which consists of the chairmen of the National Central Banks of the States Participating in the Monetary Union and members of the ECB Directorate. Traditionally, four of the six places are occupied by representatives of four major central banks: France, Germany, Italy and Spain. The Directorate of the ECB, in turn, consists of six specialists in the banking sector (Chairman, his deputy and four member), which are offered by the EU Council and after consultation with the European Parliament and the ECB Council are appointed by the European Council. Directors are prescribed for a period of eight years.

Only members of the Board of Governors, who are present person or taking part in the teleconference, have the right to vote. Member of the Board of Governors may appoint a replacement if for a long time it does not have the opportunity to attend meetings.

For voting, the presence of 2/3 of the Council members is required, however, an ECB emergency meeting may be collected, for which the threshold of those present. Decisions are made by a simple majority in the event of equality of votes, the voice of the Chair has a greater weight. Decisions on ECB capital issues, profit distribution, etc. are resolved by voting, the weight of the votes is proportional to the shares of national banks in the authorized capital of the ECB.

The priority goal of the activities of the ECB is the stability of the price (Article 127 of the EU functioning of the EU). To this end, he coordinates monetary and monetary policy, as well as a payment system with a wide toolkit, especially from 01/01/2002 through the resolution of the emission of the euro by the States parties.

The main tasks of the ECB:

Development and implementation of the monetary policy of the euro zone;

Evrical banknotes issue;

Establishing major interest rates;

Maintain price stability in the eurozone, i.e. providing the level of inflation not higher than 2%.

In addition, the ECB collects the statistical information necessary to fulfill its tasks or from governments or directly from economic agents.

The ECB has powers to the publication of legal acts, primarily the regulations, and may also impose fines (Article 132 of the EU Function Treaty).

The attitude of the ECB with other EU institutions is based primarily as part of interaction on the basis of Art. 284 EU Function Treaty. The Chairman of the EU Council and members of the Commission can take part in the meetings of the ECB Council. In addition, there is a coordination of individual issues of the ECB with the Council of Ministers of Economics and Finance. The ECB presents its annual report to the European Parliament, the Council of the EU and Commission. At the same time, the ECB is independent in matters of currency policy as in relation to participating States and in relation to the community. Only he is authorized to authorize euros emissions. He is independent in the exercise of its powers and when managing its finances. The ECB has legal personality (Art. 282 of the EU functioning of the EU). The control of the Action of the ECB is possible through the EU court.

The European Central Bank is the "heir" of the European Monetary Institute (EMI), which played a leading role in the preparations for the Euro entry in 1999. All key issues related to the activities of the European Central Bank, such as the accounting rate, accounting bills and other, are solved Directorate and Board of Management Bank.