Wiring - accrual of income tax. Wiring for income tax income tax

Accrued income tax - Typical wiring for such an operation is performed using an account plan No. 94N. If the company keeps accounting permanent / time differences and applies PBU 18/02, the accounting is complicated in terms of reflection of conditional income / consumption, as well as PNA or so on. Consider how to correctly reflect wiring for the income tax on the profits of Russian enterprises.

Account plan for reflection of settlements with the budget is offered by the account. 68. Different subaccounts can be opened to it - both by taxes, and with the breakdown of budget revenues. For example, at the income tax opens. 68.4.1 (subaccounts are open to federal and regional budgets). When using PBU 18/02 SC. 68.4.2. (The amount is made without breaking on subaccounts of budgets).

All actions with the accrual of the tax accountant performs on the loan account. 68, and when listed the obligations to the address of the IFTS records are made to the debit of sch. 68. According to the rules, the profit calculation is made by an increasing method since the beginning of the year and taking into account the amounts in the past periods. In this regard, in the formation of a declaration, the tax is determined by the total value, and the wiring is made to the difference (the data is taken. 1 declaration).

Main wiring on sch. 68:

- Accrued income tax - wiring d 99 to 68.

- Listed in the budget for income tax - Wiring D 68 K 51.

If the organization applies the norms of PBU 18/02, it is required to bring to the overall value of accounting and tax profit. In this case, the conditional accounting income / consumption is considered, and then adjustments are made depending on the profits obtained from tax accounting data. Postings will be such:

- Calculation of income tax - Wiring according to the conditional consumption of D 99 to 68, income of D 68 to 99. Calculate tax in accordance with the norms of PBU 18/02 follows, even when obtaining a conditional income, that is, a loss according to accounting data. In tax accounting in the formation of a loss to calculate the tax is not necessary.

- Upon receipt of profit in accounting less than in the tax, it is necessary to reflect accrual and then write-off - the wiring of the accrual of it d 09 to 68. Write-offs it is performed as the loss of losses d 68 to 09.

- Upon receipt of profit in accounting more than the tax, accrual is made and then repayment it is the wiring of the accrual it d 68 to 77, the write-off it d 77 to 68.

- If there are no differences in the future for various reasons, it occurs through the wiring - d 91 to 09, d 77 to 91.

Wholesale trade - wiring in accounting and tax accounting

How to fulfill the income tax on the profit of the wholesale trade enterprise, we will show the example. The company uses PBU 18/02. For 1 square. The company received a profit of 1200,000 rubles. Postage on income tax is reflected quarterly in account.

Operations are formed as follows:

- D 99 to 68 per 240000 rubles. - accrual of conditional income tax on income on the results of 1 kV.

- D 99 to 68 by 3000 rubles. - reflected in accounting.

- D 68 to 77 per 2500 rubles. - It occurs.

- D 77 to 68 per 1500 rubles. - Reflected partial write-off it.

- D 09 to 68 at 7500 rubles. - Reflected accrual it.

- D 68 to 09 by 5000 rubles. - Reflected partial repayment she.

240000 + 3000 - (2500 - 1500) + (7500-5000) \u003d 244500 rub.

- D 68 to 51 at 244500 rubles. - listed obligations to the budget.

Note! For business entities, which according to criteria refer to MP (small entrepreneurship), the use of PBU 18/02 is the right, not a duty.

For the fiscal function and control over the income of enterprises, the federal, that is, on the difference between the total amount of income and expenses. The collection became one of the key payments for the enterprise, but not all organizations pay it to be paid. Legally, it is regulated by Article No. NK RF. In this article, we will consider the main aspects and give examples of income tax postings.

- Companies and institutions engaged in gambling business.

- Enterprises in the simplified tax system.

- Agrarian organizations with the agricultural tax hold.

- Foreign companies leading organizational activities in Sochi at the Olympic and Paralympic Games.

All profit tax payers can be classified for 2 main groups:

- domestic enterprises

- foreign companies located in the territory of the Russian Federation and leading their activities with the help of official representative offices receiving profits from sources within the Russian Federation.

What profits are subject to taxation

- Russian enterprises take for profits the difference that remains from income after the deduction of all production costs. What it is the cost of the costs to call the production indicated in the NK.

- Foreign firms and companies leading their activities with representative offices and have sources of income within Russia, consider their profits difference between all the income received and the costs produced by these representative offices.

- For all other foreign organizations - revenues that were obtained from sources in the territory of the Russian Federation.

Classifier income

1. Revenues received from the provision of works or the sale of goods, property law.

Under this type of income, it is necessary to understand the entire revenue from. Implemented products can be made independently or previously purchased from another manufacturer. The volume of incoming revenue must be taken into account from all absolutely sources of admission, which can be expressed not only in cash, but also in kind.

2. Nonealization revenues

This type of income is not related to the implementation of services, goods or their production, for example:

- fines, penalties, penalties from other enterprises;

- profit for the last period, found only in the reporting period;

- changes in the currency rate in a positive side during operations in foreign currency;

- profit obtained at the expiration of its shelf life;

- enrollment of debts that were considered hopeless and were previously written off as damages;

- profit that was found during the inventory and is credited as excess.

What expenses have the right to reduce profit

Production costs are just that part that reduces the amount of income and as a result of the profit, the amount of the income tax. Costs like income are also divided into 2 groups:

1. Costs involved in the sale or production of goods and works

These are the costs that were necessary for full-fledged production or service. They have a documentary confirmation and came from the taxpayer-legal entity. All such expenses should be expressed in monetary equivalent and regulate the current legislation in the Russian Federation or within the concluded contract. In the category of these expenses, all costs that were produced solely to receive income are falling. What could be production costs:

- the cost of acquiring raw materials and materials;

- salary payments;

- the amount of accrued depreciation deductions;

- other costs.

2. Nanoalization expenses

- penalties, penalties, which were paid in favor of other enterprises;

- losses of the past years, identified only in the accountable period;

- losses obtained as a result of the content of plants temporarily canned;

- changes in currency rate in the negative side during operations in overseas currency.

- losses obtained from debt debt debt for the term of limitations or as a result of the insolvency of the partner;

- a loss formed as a result of finding shortages or damage in the inventory;

- the loss received from the write-off of not fully amortized values.

Main wiring for reflection, accrual and payment of income tax

| DT account | Account kt. | Wiring Description | Wiring amount | A document base |

| 99 | 68 | Tax size | Accounting, Declaration | |

| 68 | Reflection of deferred tax | Tax size | Accounting information, | |

| 68 | Reduced or repaid a tax asset | Scope of asset | ||

| 99 | Write-off tax asset that can no longer increase profits in the reporting and upcoming period | Scope of asset | Accounting certificate, tax registers | |

| 68 | Reflection of deferred tax liability | Accounting certificate, tax registers | ||

| 68 | Reduced or repaid a tax liability | The amount of tax liability | Accounting certificate, tax registers | |

| 99 | Write off the tax liability that will no longer increase profits in the current and next period | The amount of tax liability | Accounting certificate, tax registers | |

| 68 | Advance payment size | Bank statement | ||

| 68 |

Accounting wiring for income tax is a reflection of economic operations in accounting the organization by a double recording method. In the article, we will tell you how to properly organize in accounting company accounting of income tax, wiring are given with examples.

The main regulatory document establishing the rules for compiling accounting records for income tax (NNP) is PBU 18/02 (order of the Ministry of Finance dated November 19, 2002 No. 114n). Non-commercial organizations, as well as companies that are exempt from paying NDI, have the right to not apply these provisions. But the subjects of small entrepreneurship have the right to choose: reflect the operations on the general rules or to organize simplified accounting.

Accounting NNI.

To reflect tax records and collects in a single account plan, a separate Buchsuchi 68 is provided. To detail the information for each type of fiscal burden, special subaccounts are opening up to this account. For example, 68.4 - calculations with the budget for NNPO.

The account 68 is active - passive, that is, it can have both debit and credit balance. Moreover, the rest of the debit at the end of the settlement period indicates the presence of overpayment to the state budget. And the credit balance, on the contrary, indicates the presence of debt.

Calculation, payment and accrual of income tax reflects the wiring:

Do not forget that in accounting should reflect the advances on income tax, wiring will be the same: Dt 99 CT 68, by subaccount "NNP".

NNP is calculated by a growing result. This means that when calculating payment for the next reporting period (month, quarter), not the full amount of the advance should be indicated, but only the difference between the amounts accrued for the current period and the previous one. In other words, the amount of NNP accrual must comply with the data of the section 1 of the NNI tax return.

Reflection in accounting: example

Consider on a specific example, which records are made by the accrual of income tax, wiring for quarterly settlements with the budget.

Terms of Example:

SPRESNA LLC produces NDI calculations quarterly. Amount of accrued payments in 2020 have the following values:

- 1 quarter 2020 - 200,000 rubles;

- 1 half year 2020 - 450,000 rubles;

- 9 months 2020 - 800 000 rubles.

For 2020 (Total for the year) - 1,000,000 rubles.

The data corresponds to the line 180 of the NNI declaration for 2020, the accountant reflected the following records in accounting:

If the firm has worked at a loss

Profitability is not the only result of the company's activities during the reporting period. Quite often, enterprises are triggered at a loss. That is, in the reporting period, the expenses of the economic entity exceed the amount of income received.

In this case, the advance payment paid by the company for the previous reporting quarter or month may exceed the amount of the accrued NDI for the current period. Therefore, you need to adjust accounting data. Consider on a concrete example, how to reflect in accounting.

Spring LLC accrued advance payment for 1 quarter of 2020 in the amount of 250,000 rubles. As a result of the first half of the year, the amount of payment for NDI amounted to 200,000 rubles. Corrective data by the following accounting records:

Recall how to determine the financial result of the enterprise. The loss or profit before taxation (wiring) is defined as the difference between the inclination of the debit and credit account 99 in correspondence with accounts 90 (subaccount "Profit / loss from sales") and 91 (subaccount "balance of other income and expenses"). If the reporting period is a loan residue, this suggests that the company has received profits. Debit balance at the end of the period speaks of losses incurred.

Differences in accounting

Tax and accounting also have different norms in terms of income and expenses. For example, some types of expenditures (income) can be taken in one of the records completely and at the same time, and in the other parts for several periods or are excluded at all. As a result, there are time and permanent differences between the data well.

Temporary, or postponed - these are the differences that after a certain time expire. For example, in the BU, a certain type of costs will be made in full and immediately, and in well parts for several reporting periods. And constant differences are those income (expenses), which are accepted only in one of the accounts. For example, in the bu reflected, and in well - no.

In the inverse situation, when the amounts are lower than the amounts of the unit, there is a permanent or deferred tax obligation (IFO or it).

On how to reflect such differences in accounting, as well as on the features of the application of this NPA, we told in a separate material "who should apply PBU 18/02".

The essence of these operations is to align the data of two accounts. Otherwise, in drawing up tax and financial statements, disagreements will arise, and this is unacceptable.

Oleg good, head of the Department of Tax on Profit Organizations of the Department of Tax and Customs Policy of the Ministry of Finance of Russia.

Organizations should expect and transfer advance payments and income tax for each reporting (tax) period if the general mode is used. In this case, the accrual and payment of the tax must be reflected in accounting, as well as any other fact of economic life. It is necessary to make it taking into account the requirements of PBU 18/02. Only so you can eliminate the discrepancies that are in accounting and tax accounting. On how to apply PBU 18/02 correctly, it will be discussed in this recommendation.

Leave your data and we will call back in a few seconds

By the way, only some categories of profit tax payers may not fulfill the requirements of PBU 18/02, namely:

- credit organizations, state and municipal institutions;

- organizations that are entitled to apply simplified accounting methods, including simplified accounting (financial) reporting.

All this follows from paragraphs 1 and 2 of PBU 18/02, paragraphs 1 and 2 of Article 286, paragraph 1 of Article 289 of the Tax Code of the Russian Federation.

How to charge income tax in accounting

Accounting for the accrued and paid amounts of income tax, as well as advance payments on it, organize on account 68. To do this, discover a separate subaccount "Calculations for income tax".

Those who do not apply PBUs 18/02 are entitled to reflect in accounting tax, calculated in the declaration. Since the source of payment of tax is profit, it is necessary to accrue it in correspondence with the debit of account 99:

- Accrued income tax (advance payment) for the tax (reporting) period.

This is set by the instructions for account plan (account 68 and 99).

If you are obliged to apply PBU 18/02, then just so take and reflect in accounting income tax fixed in the declaration you can not. You will receive this quantity, but only after the values \u200b\u200bof the following indicators are summing up on the account 68:

- conditional fee for income tax calculated on the basis of accounting (balance) profit;

- conditional income on income tax, which is considered from the accounting (balance) loss;

- constant tax assets or liabilities with permanent differences, if any;

- deferred tax assets or commitments from temporary differences, if there are.

The thing is that due to differences in the composition and procedure for recognizing income and expenses, the amount of accounting (balance sheet) and taxable profits may not coincide. So, simply multiply the profit on the tax rate is not enough. This will not show in accounting the amount of real tax obligations of the organization.

Only observing the requirements of PBU 18/02 and reflecting the arising differences, one can determine in accounting the real amount of the tax. As a result, before paying the tax on the account 68 subaccount "Calculations for income tax" should remain either a loan balance (payment of payment), or at all zero (when the tax is not necessary on the declaration). Other options are possible only if the organization has overpared or incomplete income tax.

Now everything is in order. To begin with, we will define the differences that arise between accounting and tax accounting. And with how to reflect tax assets and obligations corresponding to these differences.

How to determine the constant differences and reflect in accounting appropriate tax assets and commitments

The permanent difference (PR) occurs every time any income or consumption is taken into account in whole or in part only in accounting or only during taxation. Here, for example, when this happens:

- in accounting, expenses take into account completely, and in the tax only in the established amount. This applies, for example, to interest on loans and borrowings and other expenditures in terms of income tax;

- the costs associated with the transfer to gratuitous use of property (goods, works, services) are recognized only in accounting;

- the loss was transferred to the future, but after a certain period of time (10 years), when taxed, it is impossible to consider it.

This is said in paragraph 4 of PBU 18/02.

In the same reporting period in which constant differences arose, reflect the appropriate tax assets or obligations. That is, those amounts that will be reduced or increasing tax in accounting. To account for permanent tax liabilities and assets, open the subaccount in account 99.

| Cause of permanent differences | Wiring | ||

| Revenues take into account only taxation | Permanent tax liabilities (SFO) | Increase the amount of tax | Debit 99 subaccount "Permanent tax liabilities" Credit - reflected permanent tax liability |

| Expenses that are not recognized in taxation | |||

| Revenue reflect only in accounting | Permanent Tax Assets (PNA) | Reduce tax amount | Debit 68 subaccount "Calculations for income tax" Credit 99 subaccount "Permanent tax assets" - reflected a constant tax asset |

| Expenses recognize only in taxation |

Size PNO and PNA determine by the formula:

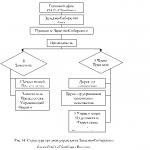

Quickly determine the PNO and the PNA will help the scheme of actions: how to determine the constant differences in accounting and what wiring to do.

During the year, constant tax liabilities and assets are not repaid. You can write them off from account 99 only in the composition of net profit or loss in the balance of the balance. At the same time, relate them to 84 "retained earnings (uncovered loss)".

Such an order is provided for in paragraph 7 of PBU 18/02 and instructions for account plan (account 68, 84 and 99)

Attention: there is an opinion that all expenses that do not take into account in the calculation of income taxes in accounting should be reflected in the composition of others. This is not true. For the error of officials are fined. If ultimately also taxes are underestimated, they will punish and the organization itself, and the amount of fines will increase. But there is a way out.

If the check is detected by a similar error of past years, because of which reporting and taxes are distorted, then it will not be possible to avoid responsibility. You will soften the consequences if you independently recalculate taxes and give out the right information, pay the penalty.

As for the errors of the current year, everything is fixable. If you correctly qualify spending, you will successfully form reporting and consider taxes. Errbial records cut.

Remember, expenses take into account depending on their purpose and conditions under which they are incurred. For example, in accounting costs are believed not only to other, but also to expenses on the usual activities (p. 4 PBU 10/99).

| Alpha's organization pays an employee compensation when its car is used for official purposes. Compensation is 5000 rubles. per month. But when calculating income tax takes into account only 1200 rubles. (Resolution of the Government of the Russian Federation of February 8, 2002 No. 92).

Mistake! Debit 20 Credit 73 Debit 91-2 Credit 73 That's right: Debit 20 (26, 44 ...) Credit 73 Here's how to fix the error: Debit 91-2 Credit 73 Debit 20 Credit 73 |

How to define temporary differences and reflect in accounting appropriate tax assets and liabilities

A temporary difference occurs if any income or consumption in accounting is taken into account in one period, and during taxation in the other. Temporary differences are two species - subtracted (VD) and taxable (NVR).

Subdued temporary difference (VD) There arises, for example, in the following situations:

- when depreciation in accounting and tax accounting consider differently. As an option, tax accounting is considered linearly, and in the accounting manner of the reduced residue;

- if there is a loss transferred to the future, which will take into account during taxation before the expiration of 10 years;

- if the costs are different in the cost of products in accounting and taxation.

Taxable temporary difference (NVR) is formed, in particular, as a result:

- applications of different depreciation methods in accounting and tax accounting. For example, in tax accounting, it is considered linearly, and in the accounting method of a reduced residue;

- when a cash register in tax accounting is used, and in accounting reflects income and expenses based on temporary certainty.

All this follows from paragraphs 8-12 PBU 18/02.

In the same reporting period in which temporary differences were arising (in full or partially), reflect and deferred tax assets or liabilities. That is, those amounts that will be reduced or increasing tax in accounting in subsequent reporting periods and which are not taken into account in the current one.

For accounting for deferred tax assets, use an account 09, and for the obligations - the account 77. In subsequent periods, as increasing income and expenses in accounting and tax accounting, deferred tax liabilities and assets repay.

This is how to reflect the emergence and repayment of deferred tax assets and liabilities:

| The reason for the occurrence of temporary differences | Type of tax assets and obligations | How affects income tax in accounting | Wiring |

| Revenues that in account of the current reporting period do not reflect | Deferred tax assets (she) | Reduce the tax amount of future reporting periods. The current period is increasing | - reflected a deferred tax asset; - repaired (fully or in part) deferred tax asset |

| Expenditures that are not recognized in taxation in the current reporting period | |||

| Income, which in taxation in the current reporting period do not take into account | Deferred tax liabilities (it) | Increase the amount of tax of future reporting periods. The current period is reduced | - reflected deferred tax liability; Debit 77 Credit 68 subaccount "Calculations for income tax" - Redempted (fully or in part) Deferred tax liability |

| The costs that in the accounting of the current reporting period do not reflect |

It is size it and it is determined by the formula:

Such an order is provided for by paragraphs 8-12, 14 and 15 of PBU 18/02.

Quickly determine it and it will help the scheme of actions: how to determine the time differences in accounting and what wiring to do.

How to reflect in accounting

Consider the conditional consumption in accordance with paragraph 20 of PBU 18/02. That is, by the formula:

Conditional consumption for income tax reflect on the subaccount of the account 99:

Debit 99 subaccount "Conditional consumption for income tax" Credit 68 subaccount "Calculations for income tax"

- Accrued conditional consumption for income tax for the reporting (tax) period.

An example of reflection in accounting accrual and payment tax payments. The organization applies PBU 18/02. Following the period in accounting and tax accounting, profit determined

According to the results of the first quarter, according to the accounting data, Alfa LLC received a profit in the amount of 1,500,000 rubles. Profit tax Organization pays quarterly. The applied income tax rate is 20 percent.

Turns for the first quarter of 68 subaccount "Calculations on income tax" amounted to:

| Indicator | Sum | Debit | Credit |

| Conditional Consumption for Profit Tax | 300 000 rub. (1 500 000 rub. × 20%) | 99 | 68 |

| Pnto | 16 000 rub. | 99 | 68 |

| It originated | 2000 rubles. | 68 | 77 |

| It is redeemed | 1000 rub. | 77 | 68 |

| She originated | 8000 rub. | 09 | 68 |

| She was repayed | 2000 rubles. | 68 | 09 |

The amount of the current income tax formed in the account 68 subaccount "Calculations on income tax" was:

300 000 rub. + 16 000 rub. - (2000 rubles. - 1000 rub.) + (8000 rub. - 2000 rub.) \u003d 321 000 rubles.

According to tax accounting, the amount of income tax for the first quarter also amounted to 321,000 rubles.

The accountant's profit tax payment reflected:

- 48 150 rubles. - listed into the federal budget of income tax for the first quarter;

Debit 68 subaccount "Calculations on income tax" Credit 51

- 272 850 rub. - Listed in the regional budget for income tax for the first quarter.

How to reflect in accounting Conditional income on income tax

Even if the organization according to accounting data in the reporting (tax) period received a loss, fix the income tax from this amount. It is called conventional income on income tax. This indicator is a product of the current income tax rate for an amount of a loss reflected in accounting. That is, it is necessary to count it like this:

Such an order is provided for in paragraph 20 of PBU 18/02.

Conditional income on income tax reflect on the subaccount of the account 99 in the same name:

Debit 68 subaccount "Calculations for income tax" Credit 99 subaccount "Conditional income on income tax"

- Accrued income tax income for the reporting (tax) period.

In tax accounting with a loss they say nothing. So, if the costs are larger than income, no profit, then the tax is not counting. The base for calculating income tax is zero. However, in future periods, the loss can reduce taxable profits (paragraph 8 of Art. 274, paragraph 1 of Art. 283 of the Tax Code of the Russian Federation).

Accounting rules Similar norms are not provided. Consequently, a subtracted temporary difference occurs. Therefore, after an incidental income on income tax is determined in accounting and it will be possible to accurately determine the size of VD, reflect in accounting it (p. 14 PBU 18/02).

In the period in which the tax loss has been determined, check in account:

Debit 09 Credit 68 subaccount "Calculations for income tax"

- reflected a deferred tax asset with a tax loss, which will be repaid in the following reporting (tax) periods.

As the loss is transferred, the indicator of the deferred tax asset is reset:

Debit 68 subaccount "Calculations on income tax" Credit 09

- The deferred tax asset has been written off from the loss redeemed.

Such an order follows from the provisions of paragraph 14 of PBU 18/02, Article 283 of the Tax Code of the Russian Federation, instructions for account plan and the letter of the Ministry of Finance of Russia dated July 14, 2003 No. 16-00-14 / 219.

An example of reflection in the accounting income tax on income and deferred tax asset. Following the tax period, the organization received a loss and tax, and in accounting

At the end of 2016, Alpha LLC received a loss:

- according to the accounting data - 100,000 rubles;

- according to tax accounting - 100,000 rubles.

According to the results of the first quarter of 2017, the profits "Alfa" amounted to:

- according to the accounting data - 200,000 rubles;

- according to tax accounting - 200,000 rubles.

Following the first half of 2017, Alfa's profits amounted to:

- according to the accounting data - 50,000 rubles;

- according to tax accounting - 50,000 rubles.

The accounts include the following entries.

Debit 68 subaccount "Calculations for income tax" Credit 99 subaccount "Conditional income on income tax"

20 000 rubles. (100,000 rubles. × 20%) - the amount of conditional income is calculated;

Debit 09 Credit 68 subaccount "Calculations for income tax"

20 000 rubles. (100 000 rub. × 20%) - reflected a deferred tax asset with a tax loss.

- 40 000 rubles. (200,000 rubles. × 20%) - acknowledged inclusive income tax for the first quarter;

Debit 68 subaccount "Calculations on income tax" Credit 09

- 20 000 rubles. (100 000 rub. × 20%) - repaid a deferred tax asset with a loss.

Debit 99 subaccount "Conditional consumption (income) for income tax" "Credit 68 subaccount" Calculations for income tax "

- 40 000 rubles. - the accrued income tax (conditional consumption) for the first quarter is repaid;

Debit 68 subaccount "Calculations on income tax" Credit 09

- 20 000 rubles. - A tax asset is restored with a loss reflected in the first quarter.

The loss of 2016 reduces taxable profits over the first half of 2017 by no more than 50 percent (paragraph 2.1 of Art. 283 of the Tax Code of the Russian Federation).

Debit 99 subaccount "Conditional consumption for income tax" Credit 68 subaccount "Calculations for income tax"

- 10 000 rubles. (50,000 rubles. × 20%) - accrued conditional income tax per half;

Debit 68 subaccount "Calculations on income tax" Credit 09

- 5000 rubles. (50,000 rubles: 2 × 20%) - repaid a deferred tax asset from a transferred tax loss that reduces taxable profits per half.

The amount of income tax reflected in the declaration in the first half of 2017 is 5000 rubles. Credit balance on account 68 subaccount "Calculations for income tax" is equal to:

10 000 rubles. - 5000 rubles. \u003d 5000 rubles.

Current income tax is reflected correctly. The reporting period is closed correctly.

An example of reflection in the accounting income tax account for income when closing the reporting period. Incounting organizations defined profits, and in tax accounting

Alpha LLC calculates income tax monthly on actual profits. Revenues and expenses in tax accounting determines the cash method. The organization applies PBU 18/02. Alpha is engaged in the provision of information services and enjoys liberation from paying VAT.

In January "Alpha" implemented services in the amount of 1,000,000 rubles.

The staff of the organization was credited as a salary in the amount of 600,000 rubles. The amount of contributions to the mandatory pension (social, medical) insurance and insurance against accidents and the caregings with the accrued salary amounted to 157,200 rubles.

As of January 31, the revenue from the implementation was not paid, the salary of the staff was not issued, the obligatory insurance premiums in the budget are not listed.

January 15, Alfa manager A.S. Kondratyev presented an advance report on travel expenses in the amount of 1200 rubles. On the same day, these expenses were reimbursed completely. Due to the exceedment of the regulatory size of the daily division in tax accounting, travel expenses were reflected in the amount of 600 rubles.

In January of other operations, Alpha was not. The accounts include the following entries:

Debit 62 Credit 90-1

- 1,000,000 rubles. - reflected revenue from the implementation of information services;

Debit 68 subaccount "Calculations for income tax" Credit 77

- 200,000 rubles. (1,000,000 rubles. × 20%) - reflected deferred tax liability from the difference between revenue reflected in accounting and tax accounting;

Debit 26 Credit 70

- 600,000 rubles. - the salary is credited for January;

Debit 09 Credit 68 subaccount "Calculations for income tax"

- 120 000 rubles. (600,000 rubles. × 20%) - reflected a deferred tax asset from the difference between the salary reflected in accounting and tax accounting;

Debit 26 Credit 69

- 157 200 rubles. - compulsory insurance premiums with salaries in January;

Debit 09 Credit 68 subaccount "Calculations for income tax"

- 31 440 rubles. (157 200 rubles. × 20%) - reflected a deferred tax asset from the difference between taxes (contributions) reflected in accounting and tax accounting;

Debit 26 Credit 71

- 1200 rubles. - Celebrated travel expenses;

- 120 rubles. ((1200 rubles. - 600 rubles.) × 20%) - reflected a constant tax liability with travel expenses reflected in accounting and tax accounting;

Debit 90-2 Credit 26

- 758 400 rubles. (600 000 rubles. + 157 200 rubles. + 1200 rubles.) - Clealed the cost of implemented services;

Debit 90-9 Credit 99 subaccount "Profit (loss) before tax"

- 241 600 rubles. (1,000,000 rubles. - 758 400 rubles) - the profit is reflected in January;

Debit 99 subaccount "Conditional consumption for income tax" Credit 68 subaccount "Calculations for income tax"

- 48 320 rubles. (241 600 rubles. × 20%) - the amount of conditional income tax rate is calculated.

In January, the tax accounting "Alfa" reflected a loss in the amount of 600 rubles. (Paid travel expenses). Since this loss will affect the determination of the tax base in the following periods, recorded record in accounting:

Debit 09 Credit 68 subaccount "Calculations for income tax"

- 120 rub. (600 rubles. × 20%) - reflected a deferred tax asset with a tax loss.

The amount of income tax reflected in the declaration in January is zero. The balance of 68 subaccount "Calculations on income tax" is equal to:

200 000 rubles. - 120 000 rubles. - 31 440 rubles. - 120 rub. - 48 320 rubles. - 120 rub. \u003d 0.

Conditional profit tax consumption is reflected correctly. The reporting period is closed correctly.

Control check

To check if you have reflected income tax calculations in accounting, use the formula:

If the resulting result coincides with the amount reflected in line 180 of the sheet 02 income tax declaration, then calculations in accounting you reflected correctly.

If the organization has no constant and temporary differences, then the income tax in the declaration should be equal to the value of the conditional consumption on it in accounting (paragraph 21 of PBU 18/02).

Details The relationship of accounting and tax accounting indicators affecting the formation of balance and taxable profits is presented in the table.

How to reflect in accounting payment tax payment

Payment for income tax in budget reflect the wiring:

Debit 68 subaccount "Calculations on income tax" Credit 51

- Listed in the federal (regional) budget for income tax (advance payment) for the tax (reporting) period.

How to take into account the feasibility of paying advance payments for income tax

Advance payments for income tax lists in one of the following methods:

- monthly based on the profits obtained in the previous quarter;

- monthly on the basis of actual profit;

- quarterly.

For those who do not apply PBU 18/02

Those who do not apply PBU 18/02, advance payments and tax reflect in accounting in the same amount as in the declaration. At the same time, it is necessary to take into account certain features. Namely, the accrued amounts may have to be adjusted:

| The method of enumeration of advance payments | Features |

| Monthly on the basis of the tax profit of the previous quarter | Following the quarter, accruem tax as in the Declaration:

Debit 99 Credit 68 subaccount "Calculations for income tax If, according to the quarter, the advance payment turned out more than the organization listed in its course, pay the difference to the budget: Debit 68 subaccount "Calculations on income tax" Credit 51 If, according to the quarter, the advance payment turned out less than the organization listed in its course, previously accrued amounts to reduce. In accounting, reflect straight: |

| Monthly based on tax actual profit | If at the end of the year the tax must be supplemented:

Debit 99 Credit 68 subaccount "Calculations for income tax" When, by the end of the year, the amount of accrued advance payments exceeded the tax per year: Debit 99 Credit 68 subaccount "Calculations for income tax" |

| Quarterly with tax profit |

An example of reflections in accounting monthly advance payments. The organization does not apply PBU 18/02, and at the end of the year defined a loss

Alpha Organization calculates monthly advance payments based on the profits received in the previous quarter.

The size of the monthly advance payment in the first quarter of 2017 is determined on the basis of a monthly payment in the third quarter of 2016 and is 50,000 rubles. Payments in this amount (taking into account the new tax distribution rates between the federal and regional budgets), the organization transferred to the budget on January 27, February 28 and March 28, 2017. These days, the Alfa accountant did in account the wiring:

Debit 68 subaccount "Calculations on income tax" Credit 51

- 50 000 rubles. - The advance payment on income tax payment for the current month is listed.

In the first quarter Alpha received a profit in the amount of 900,000 rubles. The size of a quarterly advance payment for income tax - 180,000 rubles. (900 000 rub. × 20%). According to the results of the first quarter, the organization must pay extra in the budget:

180 000 rub. - 50 000 rubles. × 3 months \u003d 30 000 rub.

Debit 99 Credit 68 subaccount "Calculations for income tax"

- 180 000 rubles. - Accrued advance payment for income tax for the first quarter.

The amount of monthly advance payment for the II quarter is:

900 000 rub. × 20%: 3 months \u003d 60 000 rub.

On April 26, the organization listed into the budget a monthly advance payment for April and surcharge following the first quarter:

30 000 rubles. + 60,000 rubles. \u003d 90,000 rubles.

Debit 68 subaccount "Calculations on income tax" Credit 51

- 30 000 rubles. - listed advance payment on income tax for the first quarter, taking into account the amounts previously paid;

Debit 68 subaccount "Calculations on income tax" Credit 51

- 60 000 rubles. - Listed monthly advance payment on income tax for April.

Similar wiring (60,000 rubles) Accountant "Alfa" made on May 29 and 28 June with the list of advance payments for May and June.

In the first half of 2017, the profits "Alpha" amounted to 2,200,000 rubles. The amount of advance payment for income tax is equal to 440,000 rubles. (2 200 000 rub. × 20%). Following the first half of the year, the organization must pay down to the budget:

440 000 rub. - 50 000 rubles. × 3 months - 30 000 rubles. - 60 000 rubles. × 3 months \u003d 80,000 rubles.

Debit 99 Credit 68 subaccount "Calculations for income tax"

- 260 000 rubles. (440 000 rubles. - 180,000 rubles) - accrued an advance payment for income tax per half, taking into account the accrued amounts.

The amount of the monthly advance payment on the III quarter is:

(2 200 000 rub. - 900 000 rub.) × 20%: 3 months. \u003d 86 666.67 rub.

On July 28, the Organization listed into the budget monthly advance payment for July and surcharge following the first half of the year:

80 000 rubles. + 86 666 rub. \u003d 166 666 rub.

Debit 68 subaccount "Calculations on income tax" Credit 51

- 80,000 rubles. - listed advance payment on income tax per half, taking into account the amounts previously paid;

Debit 68 subaccount "Calculations on income tax" Credit 51

- 86 666 rub. - The monthly advance payment for July is listed.

Similar wiring (by 86,666 rubles. And 86,668 rubles.) Accountant Alpha made on August 28 and September 28, when transferring advance payments for August and September.

For the first nine months of 2017, Alpha profits amounted to 2,900,000 rubles. The amount of advance payment for income tax is 580,000 rubles. (2 900 000 rub. × 20%). September 30, the accountant made an entry:

Debit 99 Credit 68 subaccount "Calculations for income tax"

- 140 000 rubles. (580,000 rubles. - 260 000 rubles. - 180 000 rubles) - an advance payment for income tax pay for nine months, taking into account the previously accrued amounts.

The amounts of monthly advance payments at the IV quarter of 2017 and the first quarter of 2018 are:

(2 900 000 rub. - 2 200 000 rub.) × 20%: 3 months. \u003d 46 666.67 rubles.

These amounts of the accountant reflected in a sheet 2 income tax declarations for nine months by rows 290-310 (IV quarter of 2017) and 320-340 (I quarter of 2018).

According to the results of nine months, taking into account the previously listed advance payments, the organization has arisen in the amount of:

150 000 rub. + 30 000 rubles. + 180 000 rubles. + 80,000 rubles. + 260 000 rub. - 580,000 rubles. \u003d 120 000 rub.

Therefore, during the IV quarter (until December 28, 2017), Alpha should transfer only the difference between the amount of accrued advance payment and the excessive amount paid amount to the amount of tax in the budget.

140 000 rub. - 120 000 rubles. \u003d 20 000 rub.

Debit 68 subaccount "Calculations on income tax" Credit 51

- 20 000 rubles. - The advance payment on income tax for the IV quarter of 2017 is listed.

According to the results of 2017, Alpha received a loss of 300,000 rubles. In this regard, the accountant reverses the accrued amounts of advance payments for income tax:

Debit 99 Credit 90-9 (91-9)

- 300 000 rubles. - reflected a loss obtained by the end of the year;

Debit 99 Credit 68 subaccount "Calculations for income tax"

- 580,000 rubles. - The previously accrued advance payments on income tax are reversed.

The advance payment payments listed during the year form overpayment, which can be credited to future payments or returned.

For those who use PBU 18/02

Those who use PBUs 18/02, specifically adjust the advance payments accrued in the reporting periods should not. After all, the amount of tax is formed by several indicators, and any changes will affect the size of real obligations. If at the end of the period it is revealed that the listed advance payments less than the tax for the reporting period, it must be paid in general order:

Debit 68 subaccount "Calculations on income tax" Credit 51

- The advance payment of income tax payment is listed at the end of the quarter, taking into account the amounts previously paid.

An example of reflections in accounting monthly advance payments. The organization applies PBU 18/02

Alpha LLC applies PBU 18/02. Advance payments on tax payments monthly based on the profit of the preventable quarter.

Monthly advance payments in the first quarter of 2017 "Alpha" paid on the basis of profits of the third quarter quarter:

50 000 rubles. (150 000 rub.: 3 months). At the same time, the accountant distributed the tax between the federal and regional budgets at rates, respectively, 3 and 17 percent.

Turns for the first quarter of 2017 on account 68 subaccount "Calculations on income tax" amounted to:

| Indicator | Sum | Debit | Credit |

| 150 000 rub. | 68 | 51 | |

| Conditional Consumption for Profit Tax | 260 000 rub. (1300 000 rub. × 20%) | 99 | 68 |

| Pnto | 10 000 rubles. | 99 | 68 |

| She originated | 30 000 rubles. | 09 | 68 |

| Saldo account 68 | 150 000 rub. | — | 68 |

Thus, in the first quarter, the current tax of accounting is:

300 000 rub. (260 000 rub. + 10 000 rub. + 30 000 rub.)

At the same time, in the budget for the first quarter it is necessary to pay extra:

150 000 rub. (300 000 rub. - 150 000 rub.)

Debit 68 subaccount "Calculations on income tax" Credit 51

- 150 000 rubles. - listed advance payment on income tax for the first quarter, taking into account the previously paid amounts.

Based on the profit received in the first quarter of 2017, the accountant determined the amount of the monthly advance payment for the II quarter:

100 000 rub. (300,000 rubles: 3 months)

The turnover in the first half of 2017 on the account 68 subaccount "Calculations for income tax" amounted to:

| Indicator | Sum | Debit | Credit |

| Advance payments for income tax | 600,000 rubles. | 68 | 51 |

| Conditional Consumption for Profit Tax | 560,000 rubles. (2 800 000 rub. × 20%) | 99 | 68 |

| Pnto | 10 000 rubles. | 99 | 68 |

| She originated | 30 000 rubles. | 09 | 68 |

| She was repayed | 10 000 rubles. | 68 | 09 |

| It originated | 90 000 rubles. | 68 | 77 |

| Saldo account 68 | 100 000 rubles. | 68 | — |

Thus, in the first half of the year, income tax is equal to accounting:

500 000 rub. (560 000 rub. + 10 000 rub. + (30 000 rub. -10 000 rub.) - 90 000 rub.)

This amount corresponds to taxable profits defined in the declaration. At the same time, according to the first half of the year, the organization identified overpayment on advance payments:

100 000 rubles. (600 000 rub. - 500 000 rub.)

The size of the monthly advance payment for the III quarter amounted to:

66 667 rub. ((500 000 rubles. - 300 000 rub.): 3 months)

At the same time, part of the overpayment on advance payments for the second quarter went into account III quarter.

For nine months, Alpha was recorded a balance loss of 250,000 rubles. Tax loss amounted to 270,000 rubles. Volumes for the III quarter of 2017 on account 68 subaccount "Calculations on income tax" recorded such:

| Indicator | Sum | Debit | Credit |

| 700,000 rubles. | 68 | 51 | |

| Conditional income on income tax | 50 000 rubles. (250 000 rub. × 20%) | 68 | 99 |

| Pnto | 35 000 rub. | 99 | 68 |

| She originated | 30 000 rubles. | 09 | 68 |

| She was repayed | 20 000 rubles. | 68 | 09 |

| It originated | 90 000 rubles. | 68 | 77 |

| It is redeemed | 45 000 rubles. | 77 | 68 |

Taking into account the fact that the tax accounting also turned out to be a loss, a subtracted temporary difference arose. That is, on the amount of conditional income on the income tax, the Alfa accountant reflected the emergence of a deferred tax assets:

Debit 09 Credit 68 "Profit Calculations"

- 50 000 rub. - It reflected the emergence.

Thus, the current tax over nine months in accounting is:

0 rub. (50 000 rub. - 35 000 rubles. - (30 000 rubles. + 50 000 rubles. - 20 000 rub.) + (90 000 rub. - 45 000 rub.))

At the end of nine months, the organization identified overpayment on advance payments:

700,000 rubles. (700 000 rub. - 0 rub.)

Taking into account the loss received for nine months, the Alfef's advance payments for the IV quarter do not need.

At the end of the year, Alpha determined accounting profits - 3,850,000 rubles. Tax earnings amounted to 3,700,000 rubles.

| Indicator | Sum | Debit | Credit |

| Advance payments for income tax for the quarter, total | 700,000 rubles. | 68 | 51 |

| Conditional Consumption for Profit Tax | 770 000 rub. (3 850 000 rub. × 20%) | 99 | 68 |

| PNA | 65 000 rub. | 68 | 99 |

| Pnto | 35 000 rub. | 99 | 68 |

| She originated | 80 000 rubles. | 09 | 68 |

| She was repayed | 80 000 rubles. | 68 | 09 |

| It originated | 90 000 rubles. | 68 | 77 |

| It is redeemed | 90 000 rubles. | 77 | 68 |

Thus, in just a year, the amount of income tax in accounting was:

740,000 rubles. (770 000 rub. - 65 000 rubles. + 35 000 rubles. + (80,000 rubles. - 80,000 rubles.) - (90 000 rubles. - 90 000 rubles.))

This amount corresponds to income tax in the declaration.

At the same time, to the budget for the year Alpha, you must pay extra:

40 000 rubles. (740 000 rub. - 700 000 rub.)

When surcharge, Alfa's accountant made such an entry:

Debit 68 subaccount "Calculations on income tax" Credit 51

- 40 000 rubles. - listed income tax for the year, taking into account the previously listed advance payments.

Tax agents

Tax agents, in addition to accrualing and paying tax with their own profits, should reflect the amounts taken from the income of their counterparties. The order of accounting of these amounts depends on the type of income from which the tax is held.

| Types of income | Wiring | ||

| Debit | Credit | Purpose | |

| Income from securities operations | 91-2 | 66 (67) | Accrued interest on securities (loans) |

| 66 (67) | 68 subaccount "Calculations for income tax" | Received income tax with interest on securities (loans) | |

| Dividend payment | 84 | 75-2 | Dividends are accrued |

| 75-2 | 68 subaccount "Calculations for income tax" | Interesting income tax in the payment of dividends | |

| Income from intellectual property | 20 | 76 | Licensed payments are accrued |

| 76 | 68 subaccount "Calculations for income tax" | Caused tax with payments for the use of intellectual property | |

| Revenues received by a foreign organization from the sale of property | 08 | 76 | Reflects debt to the seller for the acquired facility of fixed assets |

| 76 | 68 subaccount "Calculations for income tax" | Calculated tax on the income of a foreign organization from the sale of property | |

| Other income (for example, revenues paid by a foreign organization for the rental of its property) | 20 (26,44) | 76 | Rental charges are accrued |

| 76 | 68 subaccount "Calculations for income tax" | Received tax on revenues from rent | |

Such an order is provided for by the instructions for the account plan (account 66, 68, 75, 76).

How to reflect the income tax in the accounting of the consolidated group

Situation: as a responsible member of the consolidated group, reflect the income tax tax accrued by other participants

Before reflecting the income tax to pay on account 68, form it in general on the consolidated group (CCN) on account 78. At the same time, forming a tax, each participant must comply with PBU 18/02.

Despite the fact that the account 78 is not provided for by the plan of accounts, it is convenient to use it for synthetic accounting of calculations between the participants of the CCN. This is how the Ministry of Finance of Russia is recommended in a letter dated March 16, 2012 No. 07-02-06 / 56. After all, only the responsible member of the group can determine the total value of the tax in the whole of the CCN. "Own" tax of each participant is not yet obligations to budget. Only after all information about the tax of participants will be collected, one can determine the total amount.

What participants reflect on account 78 listed in the table:

| Responsible Member of the CCN | Other participants of the CCN |

| Current income tax with its own tax base. Instead of account 68 subaccount "Calculations for income tax". The tax must be formulated in general, that is, balancing on account 78 conditional consumption / income, permanent and deferred tax assets and liabilities | |

| Calculations with all participants of the CCN for the tax | Calculations with a responsible tax participant |

| The difference between income tax with its own tax base and what needs to be transferred to a responsible participant based on the terms of the Treaty of Creating CCN | |

| Accrual of income tax in the whole group | – |

The differences with their own tax base of each participant and the amounts that are redistributed in accordance with the Treaty of the CCN are 99 "Profit and Losses" account. This indicator will affect the amount of the net profit of the participant.

By the way, such differences may occur if the tax in the group is redistributed on the basis of the share per participant. That is, when you first determine the total tax rate for the group. Next, the tax redistribute the responsible participant in the proportion that is defined for each participant in the contract. At the same time, the amount of the tax of a particular participant does not matter. The redistribution tax can also, on another principle recorded in the CCN treaty.

In the accounting of each member of the Group, the calculations associated with the payment of income tax reflect the following wiring:

Debit 78 Credit 51

- transfer to the responsible participant money on the payment of income tax (for all group participants, except responsible);

Debit 99 Credit 78

- written off the difference between the current income tax and the one that is due to the participant, if the specified difference is negative;

Debit 78 Credit 99

- Written the difference between the current income tax and the one that is due to the participant, if the specified difference is positive.

The financial results report fill on the basis of how the financial result is recorded at the outfit period.

Profit. On line 2410 "Current Profit Tax" reflect the income tax formed by the participant with its own tax base. The difference between this indicator and obligations of the Participant under the Treaty of the CCN will reflect separately according to the fitted line 2465 "Redistribution of income tax within the consolidated group of taxpayers". Negative difference indicate in parentheses, and positive without brackets.

Lesion. If, according to the results of the reporting period, the participant received a loss, deferred tax asset do not form. In such a situation, the magnitude of the current income tax reflect on line 2410 "Current income tax" without brackets.

If even before the entrance to the CCN, the participant received a loss, he may have unsappered deferred tax assets. They do not reduce the TCN tax base. They write off their such wiring:

Debit 99 Credit 09

- A deferred tax asset is written off that does not reduce the consolidated tax base (this wiring must be made in the last reporting period until the participant's entry into the consolidated group).

Operations that reflect only the responsible participant

The responsible participant of the CCN also makes the following entries:

- accrued income tax as a whole on the CGN;

Debit 68 subaccount "Calculations on income tax" Credit 51

- Listed in the budget for the income tax.

It is advisable to open separate subaccounts to account 78 to the responsible participant for accounting for income tax with each participant. Including on itself. This will simplify control over the obligations of participants based on the terms of the CCN contract.

Repayment of obligations of the participants of the CCN Responsible reflects the wiring:

Debit 51 Credit 78

- Cash received from the group member to repay the obligation to pay for income tax.

The income tax with the consolidated tax base in the financial results does not reflect. Explanation Simple: A cumulative base for the income tax of the CGN The responsible participant forms only in tax accounting.

An example of reflection in accounting by the consolidated group of taxpayers of own income tax

Alpha LLC is a member of the consolidated group of taxpayers.

According to the results of the first quarter, the following indicators are defined in accounting, the following indicators required to calculate income tax:

The amount of current income tax formed on account 78 was:

1,000,000 rubles. + 60,000 rubles. - (20 000 rubles. - 10 000 rub.) + (80 000 rub. - 20 000 rubles.) \u003d 1 100 000 rub.

According to the Treaty of the CCN, the responsible participant identified the share of Alpha in the total tax:

1,000,000 rubles.

The positive difference between the current income tax and part of the tax of the consolidated group coming to Alpha is 100,000 rubles. (1 100 000 rub. - 1 000 000 rub.).

Write-off the difference between own tax on the "ALPA" profits and the amount for redistribution in the CCN accountant reflected the wiring:

Debit 78 Credit 99

- 100 000 rubles. - The difference between the current income tax and the amount of funds to be transferred is written off.

The report on financial results for the first quarter Accountant "Alfa" indicated:

- on line 2410 "Current income tax" - 1,100,000 rubles. (in parentheses);

- on line 2465 "Redistribution of income tax within the consolidated group of taxpayers" - 100 000 rubles. (without parentheses).

An example of reflection in accounting by the responsible participant in the income tax - own and the cumulative general on the consolidated group of taxpayers

Master manufacturing firm LLC is a responsible participant in the consolidated group of taxpayers. The rest of the group participants are:

- Alpha LLC;

- LLC "Trading Firm" Hermes ".

Following the results of the first quarter, the following indicators are defined in accounting, the following indicators are defined necessary to calculate their own income tax:

To determine the obligations on the payment of tax for each participant in the group, the "Master" group has opened the corresponding subaccounts to the account 78. The current income tax with its own tax base reflects on its subaccount "Calculations with the Master".

The amount of its own current income tax formed in the account 78 subaccount "Calculations with the Master" is:

1,300 000 rub. + 50,000 rubles. - (30,000 rubles. - 15 000 rubles.) + (95 000 rub. - 40 000 rub.) \u003d 1 390 000 rubles.

According to the results of the work of the consolidated group for the first quarter, the income tax, calculated from the total profits in the whole group, amounted to 4,200,000 rubles. The amount of tax, determined on the basis of the profit of each participant, was:

- for "alpha" - 1,000,000 rubles;

- for "Hermes" - 1,700,000 rubles;

- for "Master" - 1,500,000 rubles.

The accrual and distribution of these obligations in the "Master" accounting is reflected in the following wiring:

Debit 78 Credit 68 subaccount "Calculations for income tax"

- 4 200 000 rubles. - accrued income tax on the consolidated group of taxpayers;

Debit 78 subaccount "Calculations with Alpha" Credit 78

- 1,000,000 rubles. - reflected the amount of funds to pay the tax payable by Alpha;

Debit 78 subaccount "Calculations with" Hermes "" Credit 78

- 1,700,000 rubles. - reflected the amount of funds to pay the tax payable "Hermes";

Debit 78 subaccount "Calculations with Master" Credit 78

- 1,500,000 rubles. - reflected the amount of funds to pay the tax payable by the "Master".

Since the amount of the current income tax is less than the amount of funds payable on the consolidated calculation (1,500,000 rubles), the difference has been formed that reduces the net profit of the "Master".

Debit 99 Credit 78 subaccount "Calculations with Master" "

- 110,000 rubles. (1 500 000 rubles. - 1 390 000 rubles) - the difference between the current income tax and the amount of funds aimed at paying tax at the expense of the "Master" funds.

In the report on financial results for the first quarter, the "Master" accountant indicated:

- on line 2410 "Current income tax" - 1,390,000 rubles. (in parentheses);

- on line 2465 "Redistribution of income tax within the consolidated taxpayer group" - 110,000 rubles. (in parentheses).

Cumulative income tax on the consolidated group of taxpayers in the report on the financial results of the "Master" is not reflected.

According to the materials of the BSS "Glavbuch system"

When accrued on income tax, this operation is required by accounting postings. However, due to the differences in tax and accounting, this is not always simple, but errors are fraught with the fact that at the end of the year the total amount of tax will not come true. Therefore, read what wiring to do in one way or another.

Postings on income tax are described in PBU 18/02 "Accounting for calculations on the income tax of organizations", approved. Order of the Ministry of Finance of Russia of 11/19/02 No. 114n. To keep records of PBU 18/02 are obliged to all enterprises except:

- Small commercial organizations;

- Budget enterprises;

- Companies participating in the Skolkovo project.

At the same time, all of the listed organizations should not be included in the list of claim 5 of Article 6 of Law No. 402FZ. These companies accrual income tax hold on three accounts 68, 99 and 51, indicating there only a finished amount.

All other are used by PBU 18/02, which means that when incrusing income tax in the wiring, it is necessary to reflect all operations forming or at least somehow affecting the tax base. As done in practice, we will see now.

Profit Tax Accounting Wiring

To account for income tax, the accountant uses the following wiring:

- DT99 KT68 - accrual;

- Dt68 kt51 - payment.

Attention! The instructions for the account plan approved by the Order of the Ministry of Finance of Russia of 31.10.2000 No. 94n says that wiring to accrual income tax must be formed on the last day of the reporting period.

However, income tax is taken into account by a growing outcome since the beginning of the year. Therefore, in quarterly payments, in the first quarter, you spread on wiring directly the amount of tax that you have turned out for this period.

But for the half year and the next periods will have to make the following operation, to calculate the difference between the tax amount for the reporting segment and the one you given in the previous period. Here is this difference and will need to reflect further.

Let us give an example. Ltd. has the following profit indicators:

1 quarter - 150,000 rubles;

Half year - 273,000 rubles;

9 months - 400,000 rubles;

Annual - 600 000 rubles.

We will make earnings for income tax:

If the company fails, and the difference between the present period and the negative period, use the hardening operation. The correction is done by the same accounts: DT99 KT68 per sum of loss.

For example: in Q1 QUARTER LLC was 80,000 rubles., And in half of the year - 57,000 rubles. The loss amounted to 23 000 rubles. (80 000 - 57 000).

Accountant's income tax finishes accounts in the following wiring: DT99 KT68 or CT69 per subaccount "Accrued fines and penalties".

Conditional income tax in PBU 18/02

When the company applies PBU 18/02 just to disseminate income tax on accounts, it will not be possible. She must reflect the accounting of all the amount of tax amounts. The speech, first of all, is about the conditional income tax and its posting.

- Conditional income tax is divided into profit tax consumption - this is the amount that increases the amount of tax, and income on income tax is the amount that reduces income tax.

- The same song includes deferred tax liabilities and assets (it and it). These are the amounts that at the beginning of the reporting period increase or reduce income tax, and by the end of the year they make an inverse operation. Their important characteristics are temporary.

- But there are still permanent values \u200b\u200bthat either reduce or make the tax amount more all the time - these are constant tax liabilities (FNO) and constant tax assets (PNA).